Question: P8-3 (similar to) Question Help Cha (Computing the standard deviation for a portfolio of two risky investments) Mary Gullott recently graduated from Nichols State University

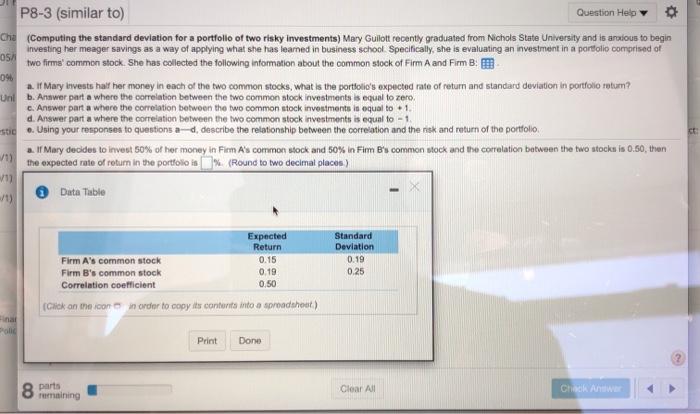

P8-3 (similar to) Question Help Cha (Computing the standard deviation for a portfolio of two risky investments) Mary Gullott recently graduated from Nichols State University and is ardous to begin investing her meager savings as a way of applying what she has learned in business School Specifically, she is evaluating an investment in a portfolio comprised of OSA two firma' common stock. She has collected the following information about the common stock of Firm A and Firm B. 04 a. If Mary livests half her money in each of the two common stocks, what is the portfolio's expected rate of return and standard deviation in portfolio rotum? Unl b. Answer part a where the correlation between the two common stock investments is equal to zero. c. Answer part a where the correlation between the two common stock investments is equal to . 1. d. Answer part a where the correlation between the two common stock investments is equal to - 1 stic. Using your responses to questions ad, describe the relationship between the correlation and the risk and return of the portfolio a. I Mary decides to invest 50% of her money in Fim As common stock and 50% in Fim B's common stock and the correlation between the two stock is 0.50, then 1) the expected rate of return in the portfolio is % (Round to two decimal places) 711 Data Table Expected Return Firm A's common stock 0.15 Firm B's common stock 0.19 Correlation coefficient 0.50 (Glok on mo.connorder to copy its contorita ito spreadshot) Standard Deviation 0.19 0.25 Print Done parts rasining Clear All Check AWE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts