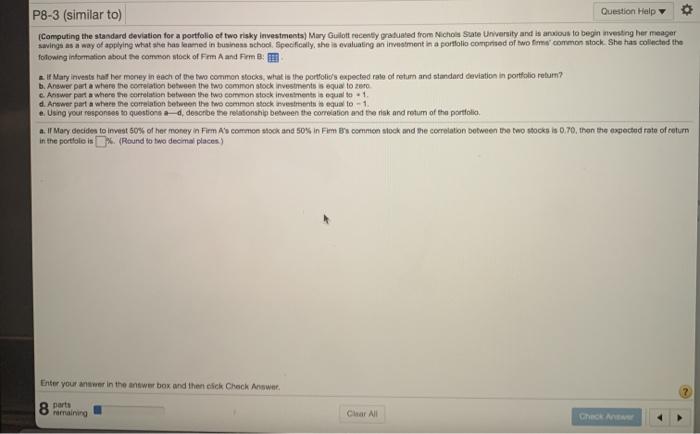

Question: P8-3 (similar to) Question Help (Computing the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from Nichos Sute University and

P8-3 (similar to) Question Help (Computing the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from Nichos Sute University and is anxious to begin investing her meager savings as a way of applying what she has learned in business school Specifionly, she is evaluating an investment in a portfolio comprised of two firme common stock. She has collected the fofowing information about the common stock of Firm Aand Firm: 2. If Mary invests funt her money in each of the two common stoces, what is the portfolio's expected rate of return and standard deviation in portfolio retum? b. Answer part a where the correlation between the two common stock investments equato 200 c. Answer part a where the correlation between the two common stock inveniment seguito 1 d. Answer part a where the correlation between the two common stock investment is equal to - 1 e. Using your responses to questions de describe the relationship between the correlation and the risk and rotum of the portfolio a. Il Mary decide to invest 50% of her money in Fim A common stock and 50% in Film By cominion stock and the correlation between the two stock is 0,70, then the expected rate of return in the portfolio is (Round to two decimal places) Enter your answer in the answer box and then click Check Answer 8 Norte oraining Clear All P8-3 (similar to) Question Help (Computing the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from Nichos Sute University and is anxious to begin investing her meager savings as a way of applying what she has learned in business school Specifionly, she is evaluating an investment in a portfolio comprised of two firme common stock. She has collected the fofowing information about the common stock of Firm Aand Firm: 2. If Mary invests funt her money in each of the two common stoces, what is the portfolio's expected rate of return and standard deviation in portfolio retum? b. Answer part a where the correlation between the two common stock investments equato 200 c. Answer part a where the correlation between the two common stock inveniment seguito 1 d. Answer part a where the correlation between the two common stock investment is equal to - 1 e. Using your responses to questions de describe the relationship between the correlation and the risk and rotum of the portfolio a. Il Mary decide to invest 50% of her money in Fim A common stock and 50% in Film By cominion stock and the correlation between the two stock is 0,70, then the expected rate of return in the portfolio is (Round to two decimal places) Enter your answer in the answer box and then click Check Answer 8 Norte oraining Clear All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts