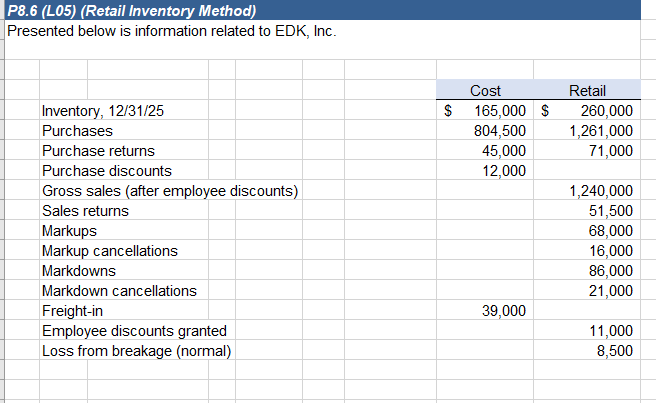

Question: P8.6 (L05) (Retail Inventory Method) Presented below is information related to EDK, Inc. Cost Retail Inventory, 12/31/25 $ 165,000 $ 260,000 Purchases Purchase returns

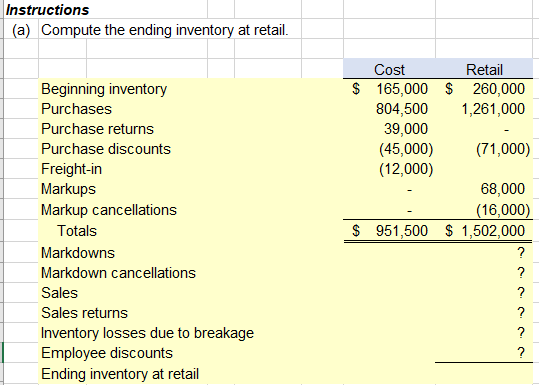

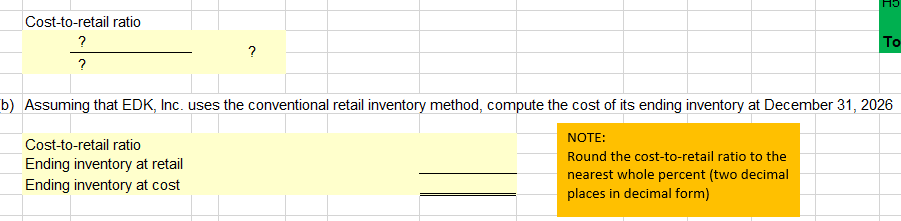

P8.6 (L05) (Retail Inventory Method) Presented below is information related to EDK, Inc. Cost Retail Inventory, 12/31/25 $ 165,000 $ 260,000 Purchases Purchase returns Purchase discounts 804,500 1,261,000 45,000 71,000 12,000 Gross sales (after employee discounts) 1,240,000 Sales returns 51,500 Markups 68,000 Markup cancellations 16,000 Markdowns 86,000 Markdown cancellations 21,000 Freight-in 39,000 Employee discounts granted 11,000 Loss from breakage (normal) 8,500 Instructions (a) Compute the ending inventory at retail. Beginning inventory Purchases Purchase returns Purchase discounts Freight-in Markups Markup cancellations Totals Markdowns Markdown cancellations Sales Sales returns Inventory losses due to breakage Employee discounts Ending inventory at retail Cost Retail $ 165,000 $ 260,000 804,500 1,261,000 39,000 (45,000) (71,000) (12,000) 68,000 (16,000) $ 951,500 $1,502,000 ? ? ? ? ? Cost-to-retail ratio ? ? To b) Assuming that EDK, Inc. uses the conventional retail inventory method, compute the cost of its ending inventory at December 31, 2026 Cost-to-retail ratio Ending inventory at retail Ending inventory at cost NOTE: Round the cost-to-retail ratio to the nearest whole percent (two decimal places in decimal form)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts