Question: P8.8 Hedging a Foreign Currency Commitment-Effects on Income On October 1, 2020, Orchid Foods agreed to sell merchandise to a Swiss customer for 500,000 swiss

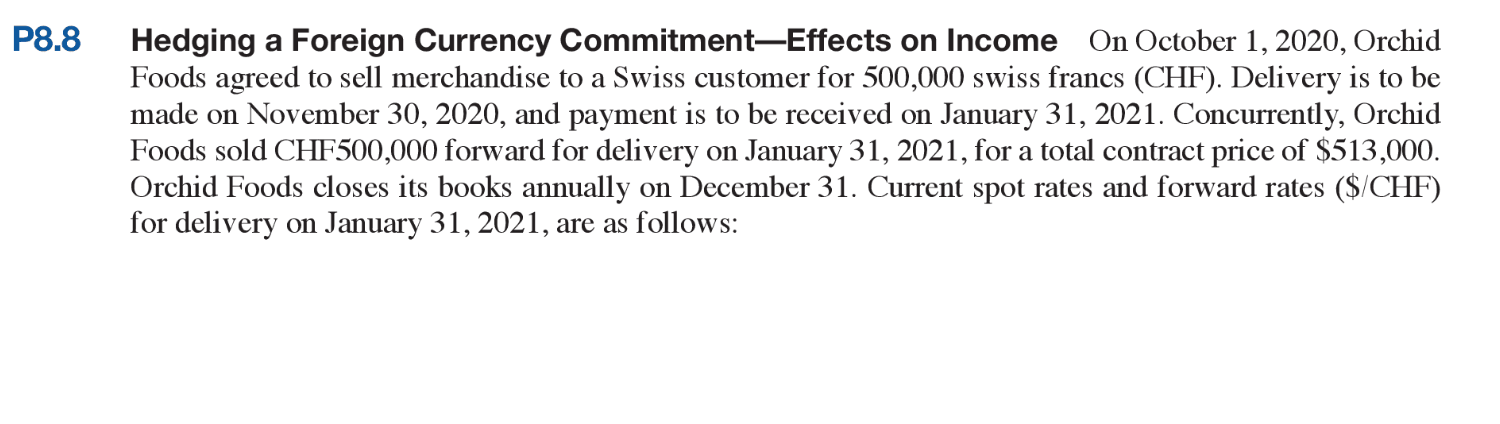

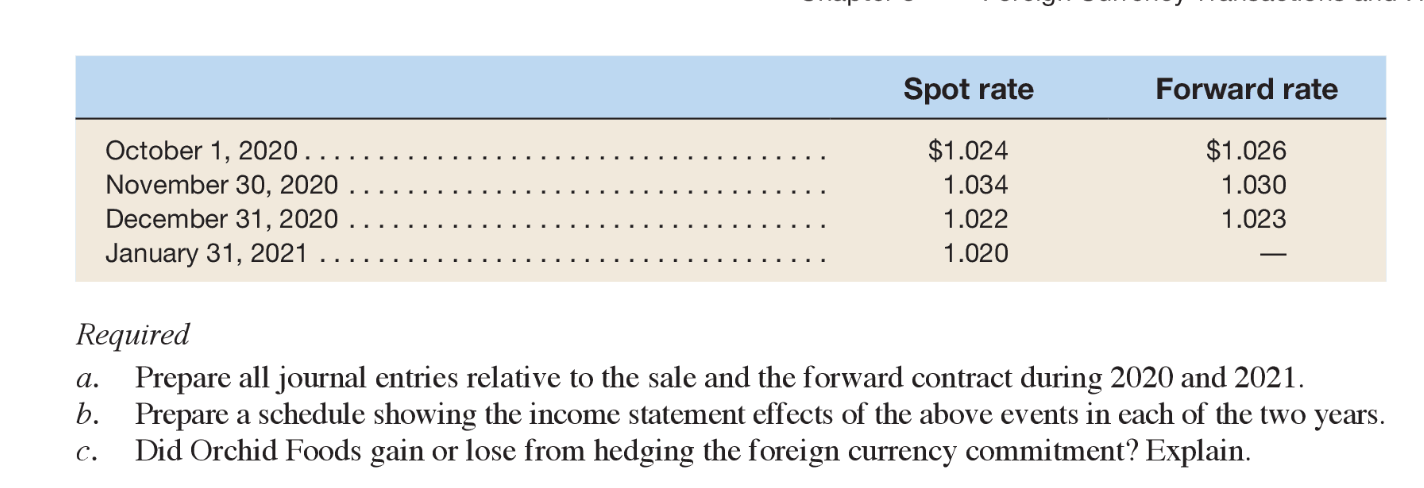

P8.8 Hedging a Foreign Currency Commitment-Effects on Income On October 1, 2020, Orchid Foods agreed to sell merchandise to a Swiss customer for 500,000 swiss francs (CHF). Delivery is to be made on November 30, 2020, and payment is to be received on January 31, 2021. Concurrently, Orchid Foods sold CHF500,000 forward for delivery on January 31, 2021, for a total contract price of $513,000. Orchid Foods closes its books annually on December 31. Current spot rates and forward rates ($/CHF) for delivery on January 31, 2021, are as follows: Spot rate Forward rate October 1, 2020... November 30, 2020 ..... December 31, 2020 ... January 31, 2021 ........ $1.024 1.034 1.022 1.020 $1.026 1.030 1.023 Required a. Prepare all journal entries relative to the sale and the forward contract during 2020 and 2021. b. Prepare a schedule showing the income statement effects of the above events in each of the two years. C. Did Orchid Foods gain or lose from hedging the foreign currency commitment? Explain. P8.8 Hedging a Foreign Currency Commitment-Effects on Income On October 1, 2020, Orchid Foods agreed to sell merchandise to a Swiss customer for 500,000 swiss francs (CHF). Delivery is to be made on November 30, 2020, and payment is to be received on January 31, 2021. Concurrently, Orchid Foods sold CHF500,000 forward for delivery on January 31, 2021, for a total contract price of $513,000. Orchid Foods closes its books annually on December 31. Current spot rates and forward rates ($/CHF) for delivery on January 31, 2021, are as follows: Spot rate Forward rate October 1, 2020... November 30, 2020 ..... December 31, 2020 ... January 31, 2021 ........ $1.024 1.034 1.022 1.020 $1.026 1.030 1.023 Required a. Prepare all journal entries relative to the sale and the forward contract during 2020 and 2021. b. Prepare a schedule showing the income statement effects of the above events in each of the two years. C. Did Orchid Foods gain or lose from hedging the foreign currency commitment? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts