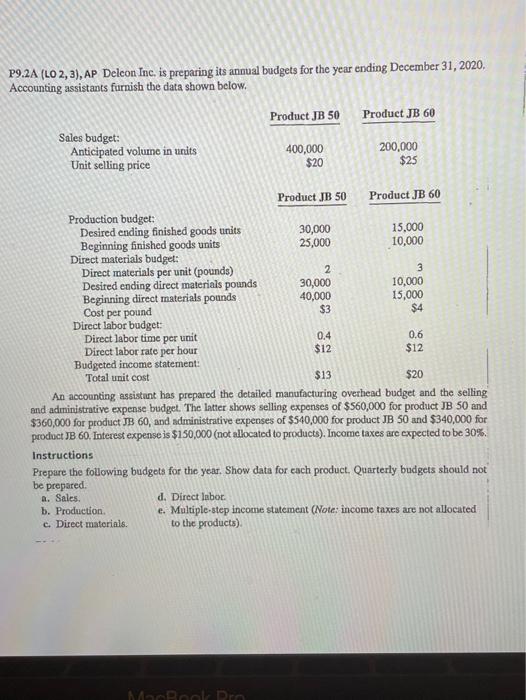

Question: P9.2A (LO 2, 3), AP Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown

P9.2A (LO 2, 3), AP Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown below. Product JB 50 Product JB 60 Sales budget: Anticipated volume in units Unit selling price 400,000 $20 200,000 $25 Product JB 50 Product JB 60 Production budget: Desired ending fini goods units 30,000 15.000 Beginning finished goods units 25,000 10,000 Direct materials budget: Direct materials per unit (pounds) 2 3 Desired ending direct materials pounds 30,000 10,000 Beginning direct materials pounds 40,000 15,000 Cost per pound $3 $4 Direct labor budget: Direct labor time per unit 0.4 0.6 Direct labor rate per hour $12 $12 Budgeted income statement: Total unit cost $13 $20 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $560,000 for product JB 50 and $360,000 for product JB 60, and administrative expenses of $540,000 for product JB 50 and $340,000 for product JB 60, Interest expense is $150,000 (not allocated to products), Income taxes are expected to be 30%. Instructions Prepare the following budgets for the year. Show data for each product Quarterly budgets should not be prepared a. Sales d. Direct Inbot. b. Production e. Multiple-step income statement (Note: income taxes are not allocated c. Direct materials. to the products) ADD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts