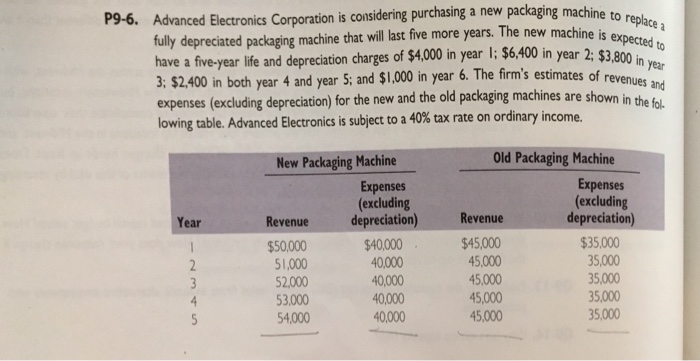

Question: P9-6. Advanced Electronics Corporation is considering purchasing a new packaging machine t to replace a expected to e more years. The new machine is exp

P9-6. Advanced Electronics Corporation is considering purchasing a new packaging machine t to replace a expected to e more years. The new machine is exp fully depreciated packaging machine that will last fiv have a five-year life and depreciation charges of $4.000 in year l: $6,400 in year 2 3: $2.400 in both year 4 and year 5; and $1.,00 in year 6. The firm's estimates of expenses (excluding depreciation) for the new and the old packaging machines are shown in the fol. lowing table. Advanced Electronics is subject to a 40% tax rate on ordinary income. of revenues and New Packaging Machine Old Packaging Machine Revenue $50,000 51,000 52.,000 53,000 54,000 Expenses (excluding depreciation) $40,000 40,000 40,000 40,000 40,000 Revenue $45,000 45,000 45,000 45,000 45,000 Expenses (excluding depreciation) $35,000 35,000 35,000 35,000 35,000 Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts