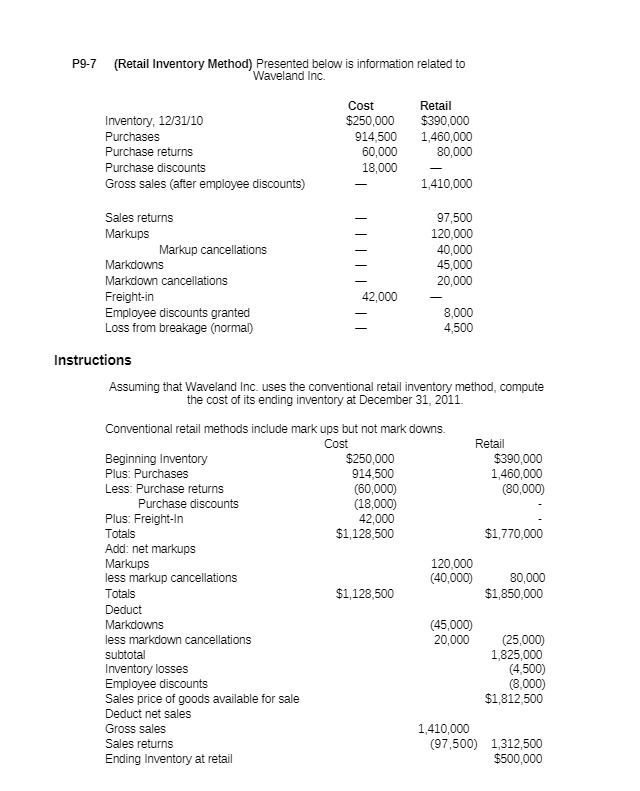

Question: P9-7 (Retail Inventory Method) Presented below is information related to Waveland Inc. Cost Retail Inventory, 12/31/10 $250,000 $390,000 Purchases 914,500 1,460,000 Purchase returns 60,000 80,000

P9-7 (Retail Inventory Method) Presented below is information related to Waveland Inc. Cost Retail Inventory, 12/31/10 $250,000 $390,000 Purchases 914,500 1,460,000 Purchase returns 60,000 80,000 Purchase discounts 18,000 Gross sales (after employee discounts) 1,410,000 Sales returns 97,500 Markups 120,000 Markup cancellations 11III 40,000 Markdowns 45,000 Markdown cancellations 20,000 Freight-in 42,000 Employee discounts granted 8,000 Loss from breakage (normal) 4,500 Instructions Assuming that Waveland Inc. uses the conventional retail inventory method, compute the cost of its ending inventory at December 31, 2011 Conventional retail methods include mark ups but not mark downs. Cost Retail Beginning Inventory $250,000 $390,000 Plus: Purchases 914,500 1,460,000 Less: Purchase returns (60,000) (80,000) Purchase discounts (18,000) Plus: Freight-In 42,000 Totals $1,128,500 $1,770,000 Add: net markups Markups 120,000 less markup cancellations (40,000) 80,000 Totals $1,128,500 $1,850,000 Deduct Markdowns (45,000) less markdown cancellations 20,000 (25,000) subtotal 1,825,000 Inventory losses (4,500) Employee discounts (8,000) Sales price of goods available for sale $1,812,500 Deduct net sales Gross sales 1,410,000 Sales returns (97,500) 1,312,500 Ending Inventory at retail $500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts