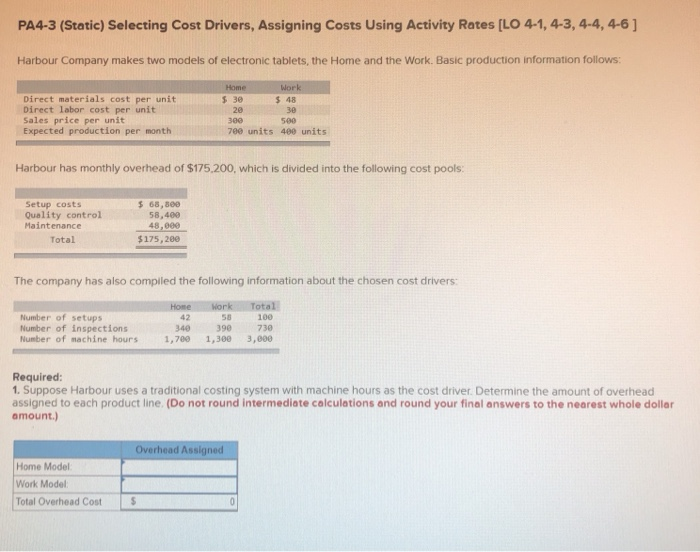

Question: PA4-3 (Static) Selecting Cost Drivers, Assigning Costs Using Activity Rates [LO 4-1, 4-3,4-4, 4-6 ] Harbour Company makes two models of electronic tablets, the Home

![4-1, 4-3,4-4, 4-6 ] Harbour Company makes two models of electronic tablets,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea9a022afc6_88166ea9a018397e.jpg)

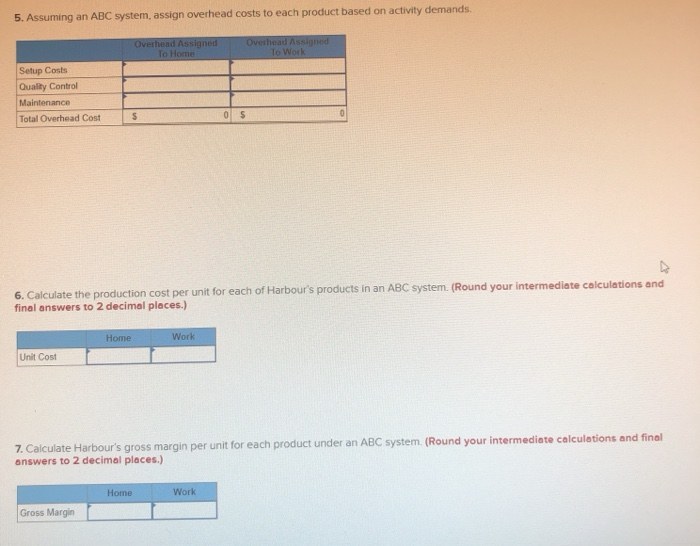

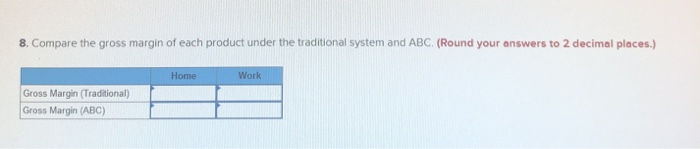

PA4-3 (Static) Selecting Cost Drivers, Assigning Costs Using Activity Rates [LO 4-1, 4-3,4-4, 4-6 ] Harbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows: Home $30 20 Work $ 48 3e Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per month 3eo 500 700 units 400 units Harbour has monthly overhead of $175,200, which is divided into the following cost pools: Setup costs Quality control Maintenance Total $ 68,800 58,400 48,000 $175, 200 The company has also compiled the following information about the chosen cost drivers: Number of setups Number of inspections Number of machine hours Home 42 340 1,700 Work 58 390 1,300 Total 100 730 3,000 Required: 1. Suppose Harbour uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Overhead Assigned Home Model Work Model Total Overhead Cost $ 0 2. Calculate the production cost per unit for each of Harbour's products under a traditional costing system. (Round your intermediate calculations and final answers to 2 decimal places.) Home Work Unit Cost 3. Calculate Harbour's gross margin per unit for each product under the traditional costing system. (Round your intermediate calculations and final answers to 2 decimal places.) Home Work Gross Margin 4. Select the appropriate cost driver for each cost pool and calculate the activity rates if Harbour wanted to implement an ABC system. Setup Costs Quality Control Maintenance 5. Assuming an ABC system, assign overhead costs to each product based on activity demands. Overhead Assigned To Home Overhead Assigned To Work Setup Costs Quality Control Maintenance Total Overhead Cost $ 0 $ 6. Calculate the production cost per unit for each of Harbour's products in an ABC system. (Round your intermediate calculations and final answers to 2 decimal places.) Home Work Unit Cost 7. Calculate Harbour's gross margin per unit for each product under an ABC system. (Round your intermediate calculations and final answers to 2 decimal places.) Home Work Gross Margin 8. Compare the gross margin of each product under the traditional system and ABC, (Round your answers to 2 decimal places.) Home Work Gross Margin (Traditional) Gross Margin (ABC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts