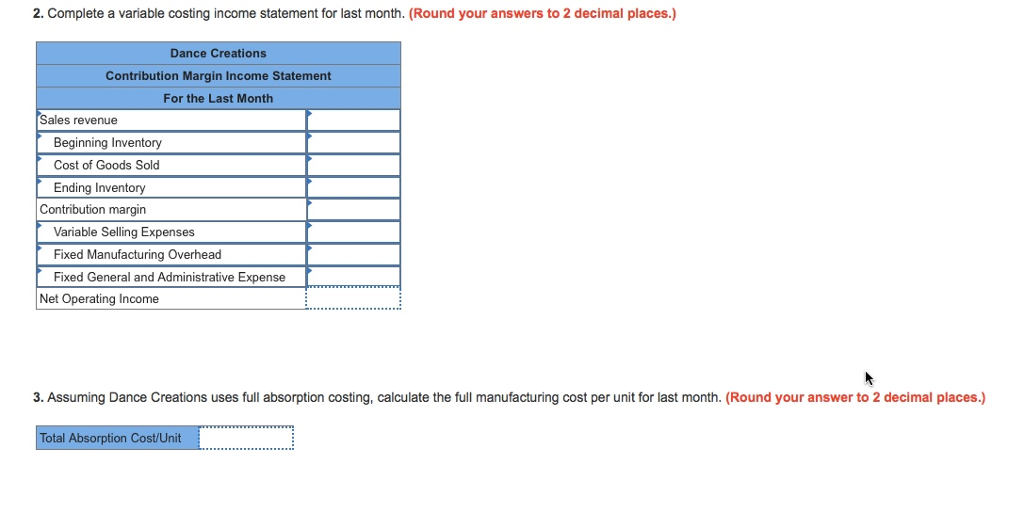

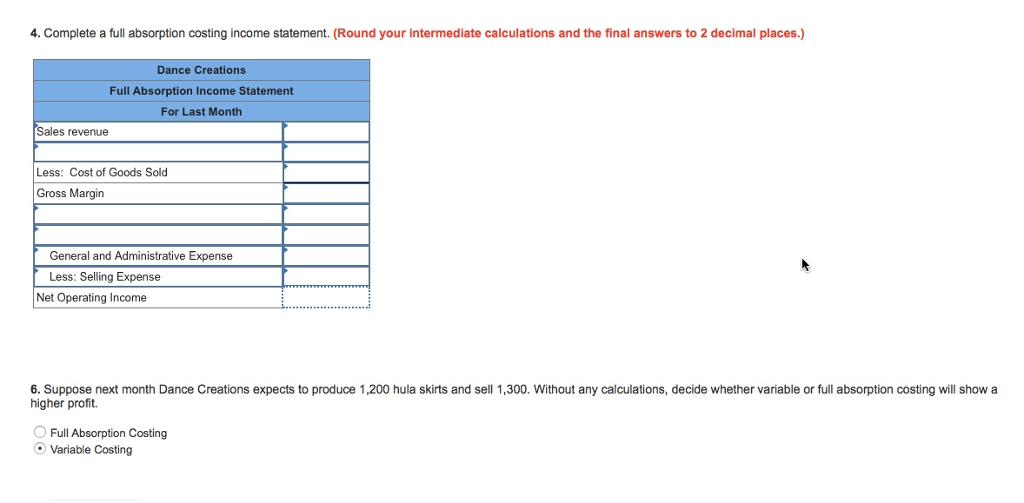

Question: PA5-6 Comparing Full Absorption and Variable Costing [LO 5S-1] Dance Creations manufactures authentic Hawaiian hula skirts that are purchased for traditional Hawaiian celebrations, costume parties,

PA5-6 Comparing Full Absorption and Variable Costing [LO 5S-1]

![PA5-6 Comparing Full Absorption and Variable Costing [LO 5S-1] Dance Creations manufactures](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fafc3ae3f82_60266fafc3a52e3b.jpg)

Dance Creations manufactures authentic Hawaiian hula skirts that are purchased for traditional Hawaiian celebrations, costume parties, and other functions. During its first year of business, the company incurred the following costs Variable Cost per Hula Skirt Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expenses $ 9.60 3.40 1.05 0.40 Fixed Cost per Month Fixed manufacturing overhead Fixed selling and administrative expenses $15,875 4,950 Dance Creations charges $30 for each skirt that it sells. During the first month of operation, it made 1,500 skirts and sold 1,375. Required 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. (Round your answer to 2 decimal places.) Total Variable Mfg Cost/Unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts