Question: PA8-1 Recording Accounts Receivable Transactions Using the Aging Method [LO 8-2] Rogala Foods, Inc. sells Oscar Mayer, Jell-O, Tassimo, and many other food brands. The

![PA8-1 Recording Accounts Receivable Transactions Using the Aging Method [LO 8-2]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbbcdcb02cb_91666fbbcdc18dac.jpg)

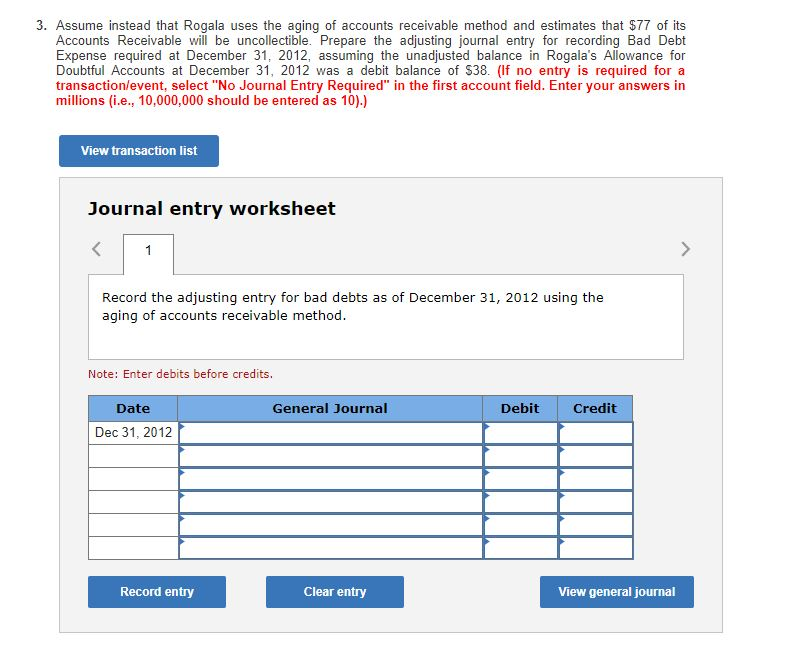

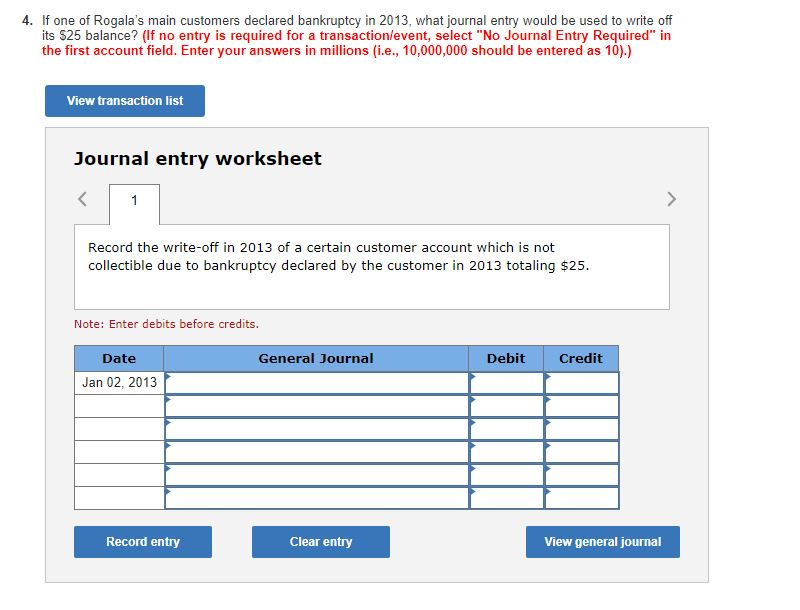

PA8-1 Recording Accounts Receivable Transactions Using the Aging Method [LO 8-2] Rogala Foods, Inc. sells Oscar Mayer, Jell-O, Tassimo, and many other food brands. The company reported the following rounded amounts as of December 29, 2012 (all amounts in millions) Debits Credits $1,040 Accounts Receivable Allowance for Doubtful Accounts Sales (assume all on credit) $ 31 17,500 Required: 1&2. Prepare the adjusting journal entry required at December 31, 2012, for recording Bad Debt Expense. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Round your answers to the nearest whole number.) (i) Assume Rogala uses 1/2 of 1 percent of sales to estimate its Bad Debt Expense for the year (ii) Assume instead that Rogala uses the aging of accounts receivable method and estimates that $77 of its Accounts Receivable will be uncollectible View transaction list Journal entry worksheet 2 Record the entry for bad debt expenses under the percentage of credit sales method Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2012 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts