Question: Paberann Preblem Set ins Problem a 1 : Plant Assets ( 5 8 polints ) Part A: Mistoric Cost and Depreciation ( 3 8 points

Paberann

Preblem Set ins

Problem a: Plant Assets polints

Part A: Mistoric Cost and Depreciation points

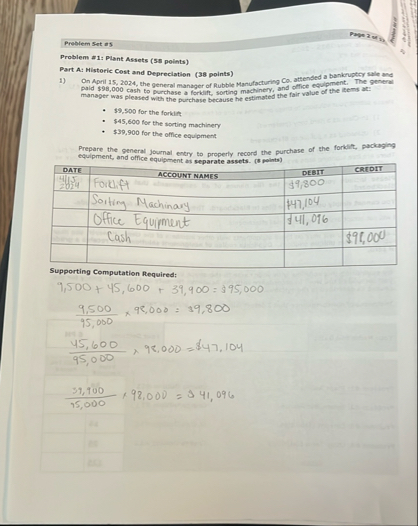

On April the general manager of Rubble Manufacturing Co attended a bankruptcy salie and paid $ cash to purchase a forklif, sorting machinery, and offlice equipment. The general manaper was pleasted with the purchase because he estimated the fair value of the items at:

$ for the forkilt

$ for the sorting machinery

$ for the office equipment

Prepare the general journal entry to properly recond the purchase of the forkdit, packaging equipment, and office equipment as separate assets. polints

tableDATEACCOUNT NAMES,DEBIT,CREDITFordify,$Soiting Machinary, Office Equipment,$Cash,,$

Supporting Computation Required:

$Problem set as

Pape of

On April Darla Shoes Inc, purchased a plot of land for iss new factory for $ cash and paid $ cash as a brokers' commission on the purchase.

Prior to constructing the new factory on the land, the company incurred $ to rembve an old bullding and other materials from the land. Darls Shoes tinc, recelved eash from salvaging the materials removed from the land. Darla Shoes Inc. also incurred in conts to level and grade the land.

On April Darfa Shoes Inc. paid $ cash for real estate taxes for the period beginning May and ending June

What was the total historic cost of the land on April as should have been recorded by Darla Shoes Inc. Inc. under GAAP? peimts

Supporting Calculationt

At December the iand had an appraised value of A similar plot of land adjacent to Darls Shoes Inci's plot sold for in December

AMALINT

In its GAAP balance sheet at December Darla Shoes Inc. would have reported the land at a total value of: peintsPage of

Problem Set

During Darla Shoes Inc. was alerted to the existence of towic waste deposils in the vicinily of its plot of lasd. The company had ils land appraised to determine its fair value. The appraiser estimated that the fair value of the land was now only $

In Rs GAAP balance sheet at December Darla Shoes Inc. would have reported the land at a total value of: polnta

In is GAAP income statement for the year ended December Darla Shoes Inc. would have reported an impaliment loss of: poims

Supporting Calculation:

On September Daria Shoes Inc. ordered a packaging machine for its factory from Paul thdustries at a price of $ Darla Shoes Inc. arranged to have the machine delivered to its factory to be deflytred by Disnster Transportation at ot test to Gurfe ef $ sme

On September Daria Shoes Inc, received the packaging machine and ingtalied and tested it at costs of $ and $ respectively.

On September Darla Shoes Inc, purchased a oneyear insurance policy on the packaging machine beginning on October at a cost of

To comply with GAAP, Darla Shoes lnc recorded the packaging machine at a tetal histeric cest value of peime

Supporting Calculation Reguired:Problem set as

Pape of

Darls Shoes Inc. Began using the machine on October

Darla Shbes Inc. uses the straightline method to depreciate the packaging machine. The company estimates the packaging machine will have a useful life of years and a salvage walue of $

Preppre the adjusting general journal entry to properly record the deprnciation on the packaging machine at December peless

tableDATEACCOUNT NAMES,DEBIT,,

Supporting Computation Required:

In December Darla Shoes Inc. hired an appraiser to estimate the packaging machine's value. At December the appraiser presented a report indicating the machine had an estimated fale value of $

In its GAAP balance sheet at December Darla Shoes Inc. reported the packaging machine at a net carrying value of: pointa

Supporting Computation Required:Problem Set

Page of

Calcutate the following amounts relative to the packaging machine as th

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock