Question: Packet Exercise 9.2 Continued Compute the amount of a liability with an annuity: Boujee Inc. purchased equipment on 1/1/2020. The company financed the purchase

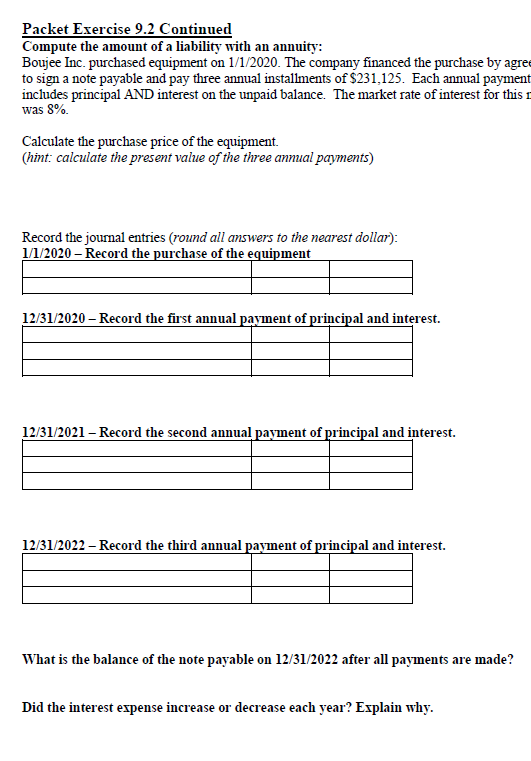

Packet Exercise 9.2 Continued Compute the amount of a liability with an annuity: Boujee Inc. purchased equipment on 1/1/2020. The company financed the purchase by agree to sign a note payable and pay three annual installments of $231,125. Each annual payment includes principal AND interest on the unpaid balance. The market rate of interest for this r was 8%. Calculate the purchase price of the equipment. (hint: calculate the present value of the three annual payments) Record the journal entries (round all answers to the nearest dollar): 1/1/2020-Record the purchase of the equipment 12/31/2020 - Record the first annual payment of principal and interest. 12/31/2021 - Record the second annual payment of principal and interest. 12/31/2022-Record the third annual payment of principal and interest. What is the balance of the note payable on 12/31/2022 after all payments are made? Did the interest expense increase or decrease each year? Explain why.

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

journal entry date particulars debit credit 010120 By Equipment ac 595609 To notes payable ac ... View full answer

Get step-by-step solutions from verified subject matter experts