Question: Pact Trucking Corporation uses the units-of-production depreciation method because units-of-production best measures wear and tear on the trucks. Consider these facts about one Mack truck

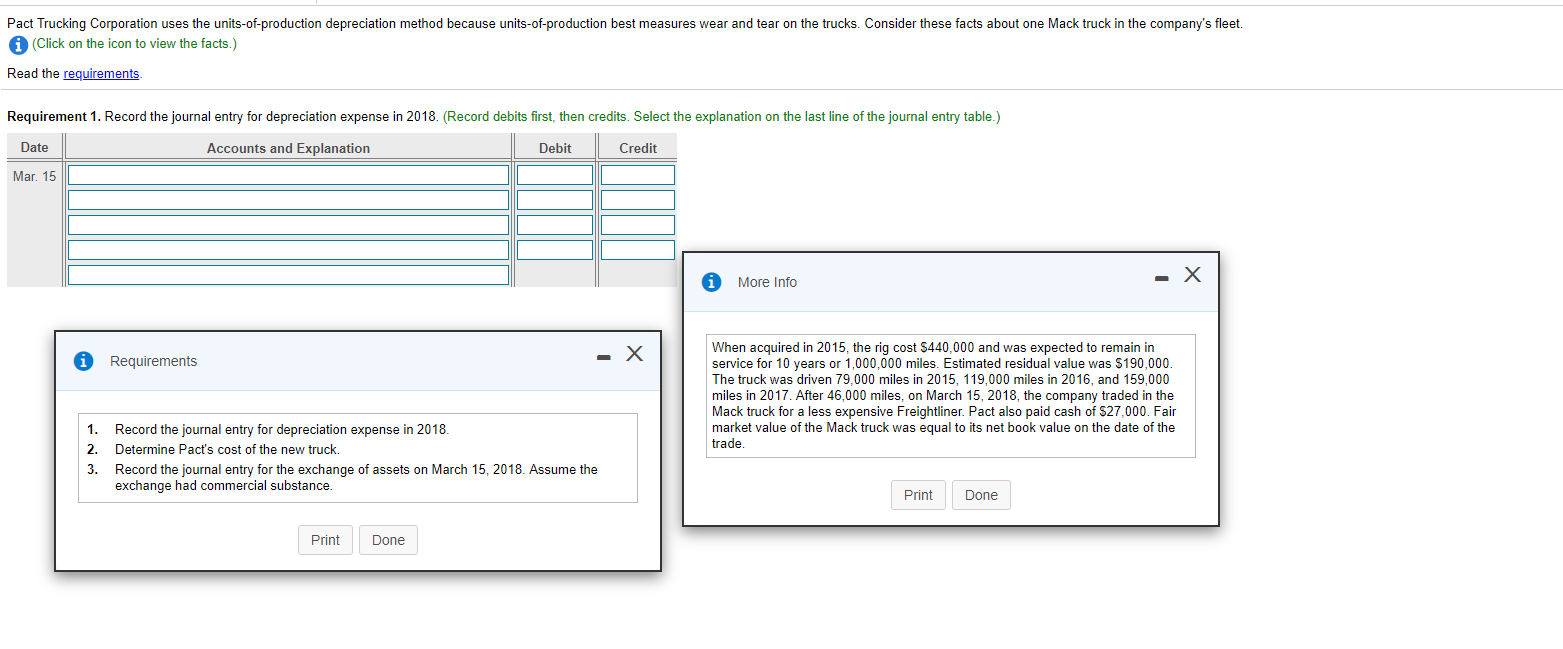

Pact Trucking Corporation uses the units-of-production depreciation method because units-of-production best measures wear and tear on the trucks. Consider these facts about one Mack truck in the company's fleet. (Click on the icon to view the facts.) Read the requirements Requirement 1. Record the journal entry for depreciation expense in 2018. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Mar. 15 - X More Info i Requirements - X When acquired in 2015, the rig cost $440,000 and was expected to remain in service for 10 years or 1,000,000 miles. Estimated residual value was $190,000. The truck was driven 79,000 miles in 2015, 119,000 miles in 2016, and 159,000 miles in 2017. After 46,000 miles, on March 15, 2018, the company traded in the Mack truck for a less expensive Freightliner. Pact also paid cash of $27,000. Fair market value of the Mack truck was equal to its net book value on the date of the trade. 1. 2. 3. Record the journal entry for depreciation expense in 2018. Determine Pact's cost of the new truck. Record the journal entry for the exchange of assets on March 15, 2018. Assume the exchange had commercial substance. Print Done Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts