Question: Pad 13:58 a chegg.com Financial Reporting, Financial Statement Analysis a (7th Edition) Chapter 6, Problem 3IC Bookmark Show all steps ON Problem REQUIRED a. Using

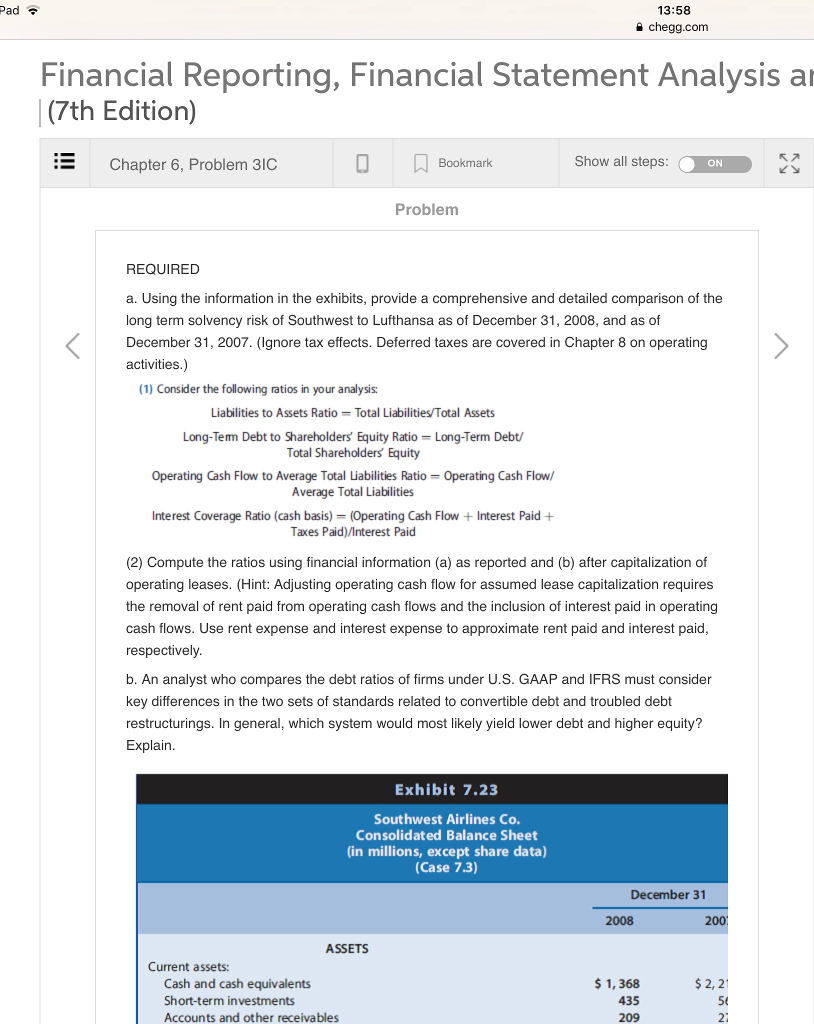

Pad 13:58 a chegg.com Financial Reporting, Financial Statement Analysis a (7th Edition) Chapter 6, Problem 3IC Bookmark Show all steps ON Problem REQUIRED a. Using the information in the exhibits, provide a comprehensive and detailed comparison of the long term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31,2007.(ignore tax effects. Deferred taxes are covered inChapter 8 on operating> activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio Total Liabilities/Total Assets Long-Tem Debt to Shareholders Equity Ratio Long-Term Debt/ Total Shareholders Equity Operating Cash Flow to Average Total Liabilities Ratio Operating Cash Flow Average Total Liabilities Interest Coverage Ratio (cash basis) (Operating Cash Flow +Interest Paid Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitalization of operating leases. (Hint: Adjusting operating cash flow for assumed lease capitalization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid respectively. b. An analyst who compares the debt ratios of firms under U.S. GAAP and IFRS must consider key differences in the two sets of standards related to convertible debt and troubled debt restructurings. In general, which system would most likely yield lower debt and higher equity? Explain Exhibit 7.23 Southwest Airlines Co. Consolidated Balance Sheet in millions, except share data) (Case 7.3) December 31 2008 200 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables 1, 368 435 209 $2,21 50 2: Pad 13:58 a chegg.com Financial Reporting, Financial Statement Analysis a (7th Edition) Chapter 6, Problem 3IC Bookmark Show all steps ON Problem REQUIRED a. Using the information in the exhibits, provide a comprehensive and detailed comparison of the long term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31,2007.(ignore tax effects. Deferred taxes are covered inChapter 8 on operating> activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio Total Liabilities/Total Assets Long-Tem Debt to Shareholders Equity Ratio Long-Term Debt/ Total Shareholders Equity Operating Cash Flow to Average Total Liabilities Ratio Operating Cash Flow Average Total Liabilities Interest Coverage Ratio (cash basis) (Operating Cash Flow +Interest Paid Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitalization of operating leases. (Hint: Adjusting operating cash flow for assumed lease capitalization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid respectively. b. An analyst who compares the debt ratios of firms under U.S. GAAP and IFRS must consider key differences in the two sets of standards related to convertible debt and troubled debt restructurings. In general, which system would most likely yield lower debt and higher equity? Explain Exhibit 7.23 Southwest Airlines Co. Consolidated Balance Sheet in millions, except share data) (Case 7.3) December 31 2008 200 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables 1, 368 435 209 $2,21 50 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts