Question: Pad 4:06 PM True Documents Undo You are to write a C program to compute federal personal income taxes. Program is to have no global

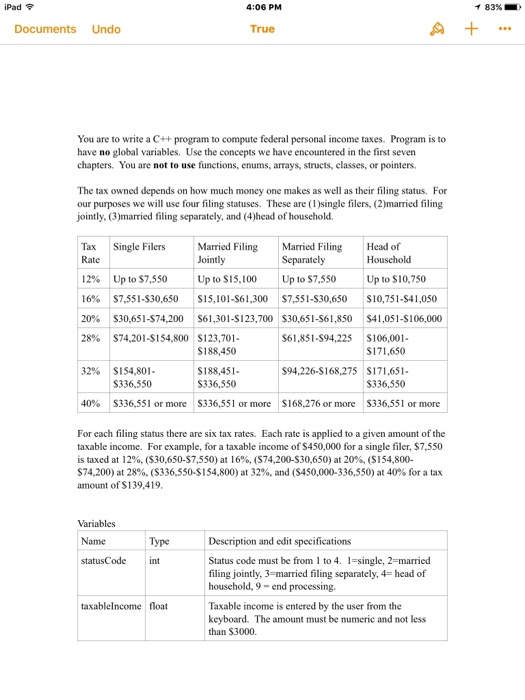

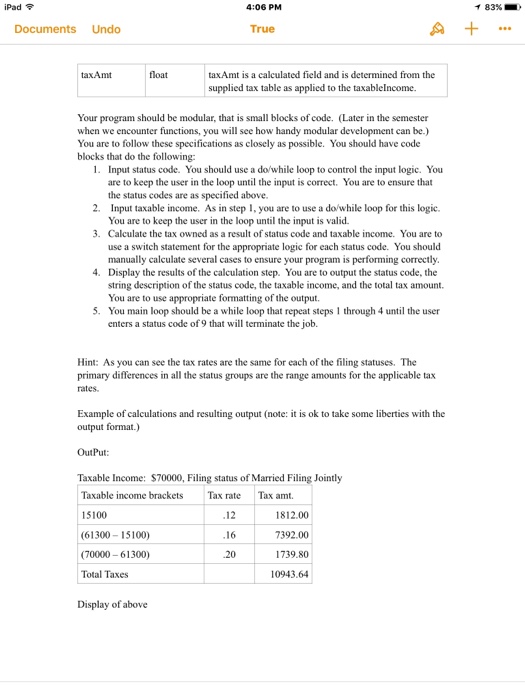

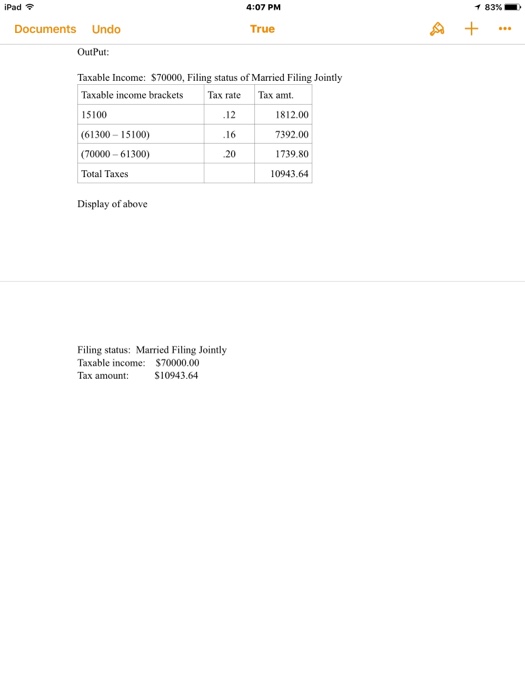

Pad 4:06 PM True Documents Undo You are to write a C program to compute federal personal income taxes. Program is to have no global variables. Use the concepts we have encountered in the first seven chapters. You are not to use functions, enums, arrays, structs, classes, or pointers. The tax owned depends on how much money one makes as well as their filing status. For our purposes we will use four filing statuses. These are (1)single filers, (2)married filing jointly, G)married filing separately, and (4)head of household. Tax Single Filers Mamied Filing Married Filing Head of Jointly Household Separately 12% Up to S 7,550 Upto S15.100 Up to S7.S50 Up to S10,750 16% S7,551-S30, 650 S15,101-S61,300 $7,551-S30, 650 S10,751-S41,050 20% S30,651-S74,200 S61,301-S123,700 $30,651-S61,850 S41,051-S106,000 28% S74.201-S154,800 S123,701- $61,851-S94,225 $106,001 S188,450 S171,650 32% S154,801- S188,451- $94,226 S168,275 S171,651- S336,550 S336,550 S336,550 40% S336,551 or more S336,551 or more S168.276 or more S336,551 or more For each filing status there are six tax rates. Each rate is applied to a given amount of the taxable income. For example, for a taxable income ofS450,000 for a single filer, $7,550 is taxed at 12%, (S30,650-S7,550) at 16%, (S74,200-S30,650) at 20% (S154,800- S74,200) at 28%, (S336,550-S154,800) at 32%, and (S450,000-336,550) at 40% for a tax amount of S139,419. Variables Name lype Description and edit specifications statusCode int Status code must be from l to 4. 1 gle, 2 married filing jointly, 3 married filing separately, 4 head of household, 9-end processing. taxable Income float Taxable income is entered by the user from the keyboard. The amount must be numeric and not less than S3000. 83%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts