Question: Pad 9:51 PM Exercise 2 (LO 2) Block purchase, control with first block. Baker Corporation pur chases a 60% interest in Hardee Company on January

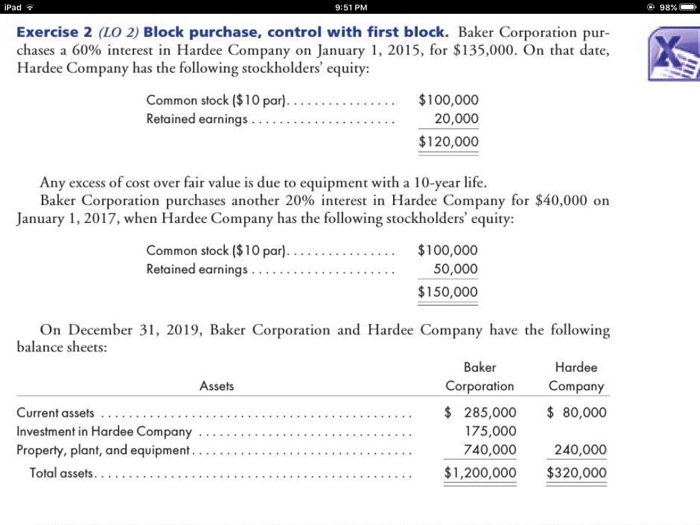

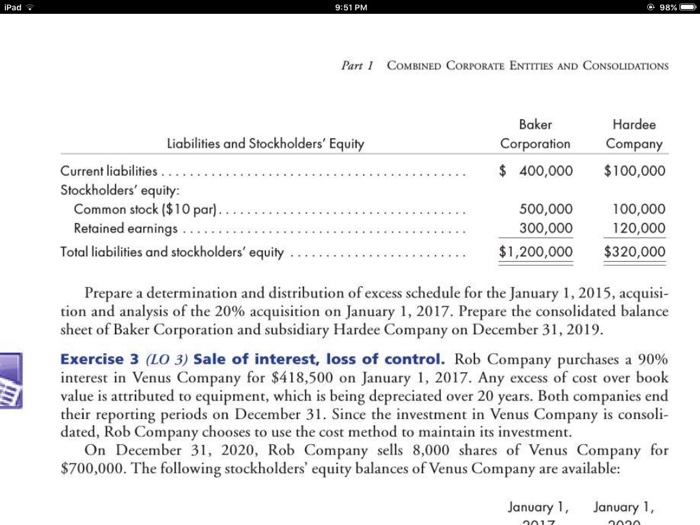

Pad 9:51 PM Exercise 2 (LO 2) Block purchase, control with first block. Baker Corporation pur chases a 60% interest in Hardee Company on January 1, 2015, for $135,000. On that date, Hardee Company has the following stockholders' equity: common stock ($10 par) $100,000 Retained earnings 20,000 $120,000 Any excess of cost over fair value is due to equipment with a 10-year life. Baker Corporation purchases another 20% interest in Hardee Company for $40,000 on January 1, 2017, when Hardee Company has the following stockholders' equity: Common stock ($10 par). $100,000 50,000 Retained earnings $150,000 On December 31, 2019, Baker Corporation and Hardee Company have the following balance sheets: Baker Hardee Corporation Company Assets 285,000 80,000 Current assets 175,000 Investment in Hardee Company Property, plant, and equipment. 740,000 240,000 Total assets $1,200,000 $320,000 98% Pad 9:51 PM Exercise 2 (LO 2) Block purchase, control with first block. Baker Corporation pur chases a 60% interest in Hardee Company on January 1, 2015, for $135,000. On that date, Hardee Company has the following stockholders' equity: common stock ($10 par) $100,000 Retained earnings 20,000 $120,000 Any excess of cost over fair value is due to equipment with a 10-year life. Baker Corporation purchases another 20% interest in Hardee Company for $40,000 on January 1, 2017, when Hardee Company has the following stockholders' equity: Common stock ($10 par). $100,000 50,000 Retained earnings $150,000 On December 31, 2019, Baker Corporation and Hardee Company have the following balance sheets: Baker Hardee Corporation Company Assets 285,000 80,000 Current assets 175,000 Investment in Hardee Company Property, plant, and equipment. 740,000 240,000 Total assets $1,200,000 $320,000 98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts