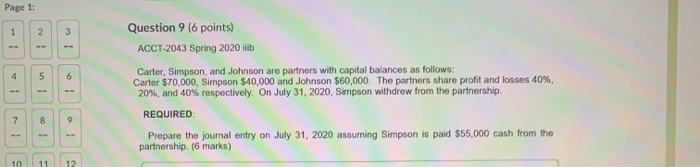

Question: Page 1: 2 3 Question 9 (6 points) ACCT-2043 Spring 2020 iib Carter, Simpson, and Johnson are partners with capital balances as follows: Carter $70,000,

Page 1: 2 3 Question 9 (6 points) ACCT-2043 Spring 2020 iib Carter, Simpson, and Johnson are partners with capital balances as follows: Carter $70,000, Simpson $40,000 and Johnson $60,000. The partners share profit and losses 40%, 20%, and 40% respectively. On July 31, 2020, Simpson withdrew from the partnership 4 5 6 REQUIRED 7 8 9 Prepare the journal entry on July 31, 2020 assuming Simpson is paid $55,000 cash from the partnership. (6 marks) 10 11 12 Page 1: 2 3 Question 9 (6 points) ACCT-2043 Spring 2020 iib Carter, Simpson, and Johnson are partners with capital balances as follows: Carter $70,000, Simpson $40,000 and Johnson $60,000. The partners share profit and losses 40%, 20%, and 40% respectively. On July 31, 2020, Simpson withdrew from the partnership 4 5 6 REQUIRED 7 8 9 Prepare the journal entry on July 31, 2020 assuming Simpson is paid $55,000 cash from the partnership. (6 marks) 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts