Question: Page < 10 > Centralia Example Here is a summary of the key points: The current exchange rate in American terms is S =

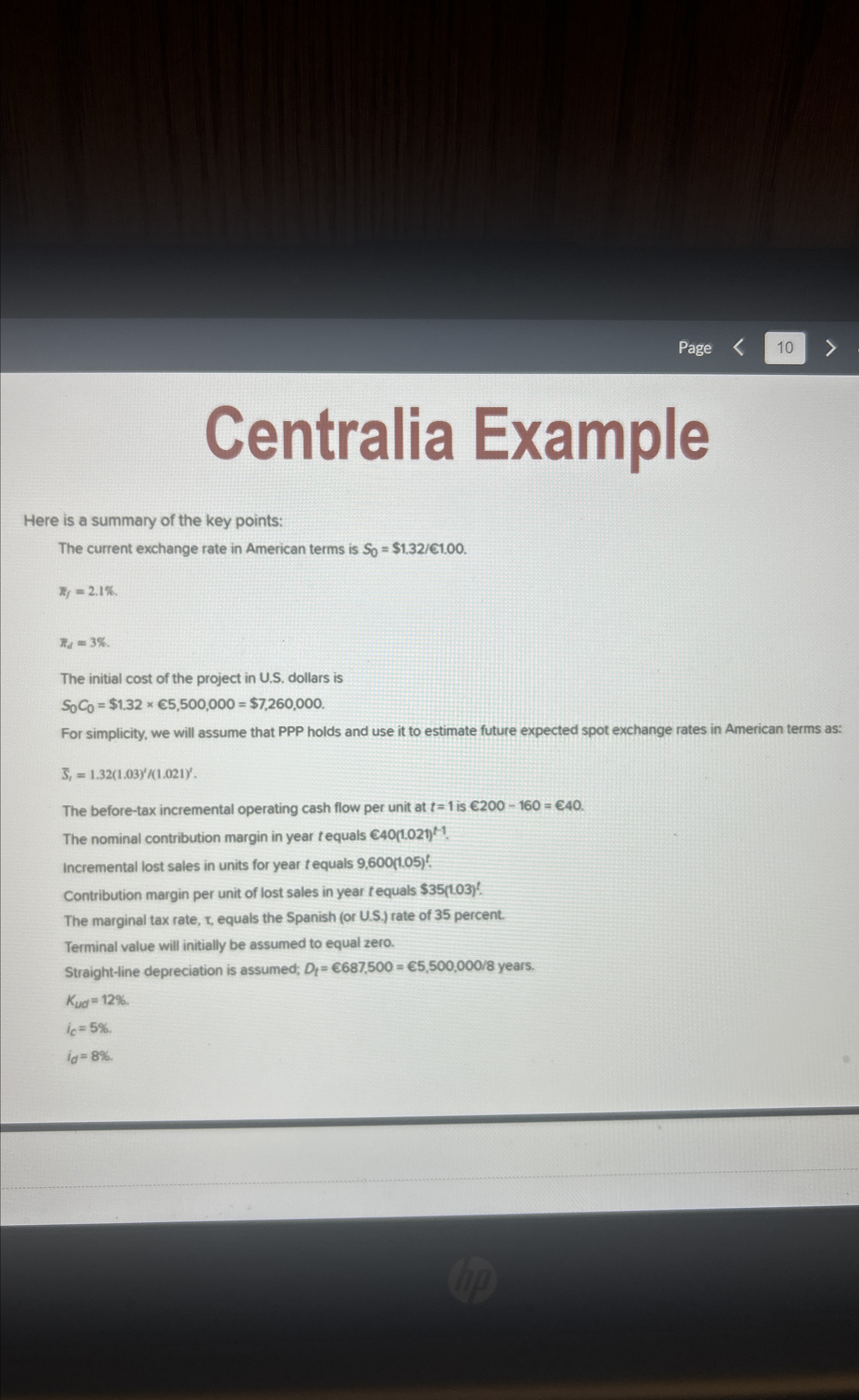

Page < 10 > Centralia Example Here is a summary of the key points: The current exchange rate in American terms is S = $1.32/1.00. Ry=2.1% R=3%. The initial cost of the project in U.S. dollars is SoCo = $1,32 5,500,000 = $7,260,000. For simplicity, we will assume that PPP holds and use it to estimate future expected spot exchange rates in American terms as: 3,1.32(1.03)/(1.021)'. The before-tax incremental operating cash flow per unit at t=1 is 200 - 160 = 40. The nominal contribution margin in year t equals 40(1.021)^! Incremental lost sales in units for year t equals 9,600(1.05). Contribution margin per unit of lost sales in year t equals $35(1.03)! The marginal tax rate, t, equals the Spanish (or U.S.) rate of 35 percent. Terminal value will initially be assumed to equal zero. Straight-line depreciation is assumed; D = 687,500 = 5,500,000/8 years. Kud = 12%. ic = 5%. id=8%. hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts