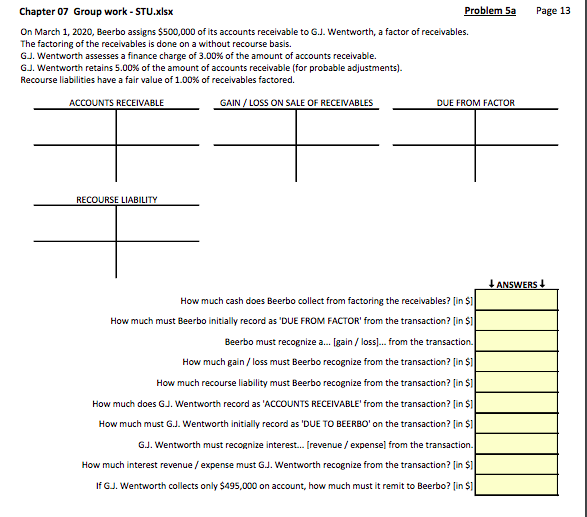

Question: Page 13 Chapter 07 Group work - STU.xlsx Problem 5a On March 1, 2020, Beerbo assigns $500,000 of its accounts receivable to G.J. Wentworth, a

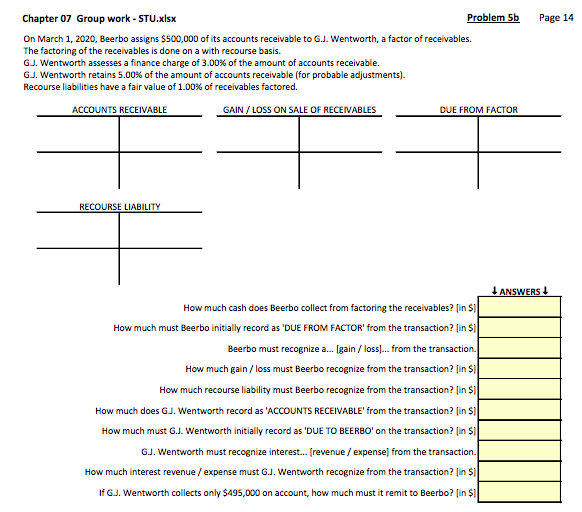

Page 13 Chapter 07 Group work - STU.xlsx Problem 5a On March 1, 2020, Beerbo assigns $500,000 of its accounts receivable to G.J. Wentworth, a factor of receivables. The factoring of the receivables is done on a without recourse basis. GJ. Wentworth assesses a finance charge of 3.00% of the amount of accounts receivable. GJ. Wentworth retains 5.00% of the amount of accounts receivable (for probable adjustments). Recourse liabilities have a fair value of 1.00% of receivables factored. ACCOUNTS RECEIVABLE GAIN / LOSS ON SALE OF RECEIVABLES DUE FROM FACTOR RECOURSE LIABILITY ANSWERS How much cash does Beerbo collect from factoring the receivables? (in $il How much must Beerbo initially record as 'DUE FROM FACTOR' from the transaction? [in $il Beerbo must recognize a... [gain / loss)... from the transaction How much gain / loss must Beerbo recognize from the transaction? [in $1 How much recourse liability must Beerbo recognize from the transaction? [in $1 How much does GJ. Wentworth record as 'ACCOUNTS RECEIVABLE' from the transaction? [in $il How much must G.J. Wentworth initially record as 'DUE TO BEERBO' on the transaction? fin $il G.J. Wentworth must recognize interest... [revenue / expense from the transaction. How much interest revenue / expense must G.J. Wentworth recognize from the transaction? fin $1 If GJ. Wentworth collects only $495,000 on account, how much must it remit to Beerbo? in $1 Chapter 07 Group work - STU.xlsx Problem 5b Page 14 On March 1, 2020, Beerbo assigns $500,000 of its accounts receivable to G.J. Wentworth, a factor of receivables. The factoring of the receivables is done on a with recourse basis. GJ. Wentworth assesses a finance charge of 3.00% of the amount of accounts receivable. GJ. Wentworth retains 5.00% of the amount of accounts receivable (for probable adjustments). Recourse liabilities have a fair value of 1.00% of receivables factored. ACCOUNTS RECEIVABLE GAIN / LOSS ON SALE OF RECEIVABLES DUE FROM FACTOR RECOURSE LIABILITY + ANSWERS How much cash does Beerbo collect from factoring the receivables? fin $il How much must Beerbo initially record as 'DUE FROM FACTOR' from the transaction? [in $1 Beerbo must recognize a... [gain / loss)... from the transaction How much gain / loss must Beerbo recognize from the transaction? [in $1 How much recourse liability must Beerbo recognize from the transaction? [in $1 How much does GJ. Wentworth record as 'ACCOUNTS RECEIVABLE' from the transaction? [in $1 How much must G.J. Wentworth initially record as 'DUE TO BEERBO' on the transaction? fin $ G.J. Wentworth must recognize interest... (revenue / expense) from the transaction How much interest revenue / expense must G.J. Wentworth recognize from the transaction? fin $1 If GJ. Wentworth collects only $495,000 on account, how much must it remit to Beerbo? fin $1 Page 13 Chapter 07 Group work - STU.xlsx Problem 5a On March 1, 2020, Beerbo assigns $500,000 of its accounts receivable to G.J. Wentworth, a factor of receivables. The factoring of the receivables is done on a without recourse basis. GJ. Wentworth assesses a finance charge of 3.00% of the amount of accounts receivable. GJ. Wentworth retains 5.00% of the amount of accounts receivable (for probable adjustments). Recourse liabilities have a fair value of 1.00% of receivables factored. ACCOUNTS RECEIVABLE GAIN / LOSS ON SALE OF RECEIVABLES DUE FROM FACTOR RECOURSE LIABILITY ANSWERS How much cash does Beerbo collect from factoring the receivables? (in $il How much must Beerbo initially record as 'DUE FROM FACTOR' from the transaction? [in $il Beerbo must recognize a... [gain / loss)... from the transaction How much gain / loss must Beerbo recognize from the transaction? [in $1 How much recourse liability must Beerbo recognize from the transaction? [in $1 How much does GJ. Wentworth record as 'ACCOUNTS RECEIVABLE' from the transaction? [in $il How much must G.J. Wentworth initially record as 'DUE TO BEERBO' on the transaction? fin $il G.J. Wentworth must recognize interest... [revenue / expense from the transaction. How much interest revenue / expense must G.J. Wentworth recognize from the transaction? fin $1 If GJ. Wentworth collects only $495,000 on account, how much must it remit to Beerbo? in $1 Chapter 07 Group work - STU.xlsx Problem 5b Page 14 On March 1, 2020, Beerbo assigns $500,000 of its accounts receivable to G.J. Wentworth, a factor of receivables. The factoring of the receivables is done on a with recourse basis. GJ. Wentworth assesses a finance charge of 3.00% of the amount of accounts receivable. GJ. Wentworth retains 5.00% of the amount of accounts receivable (for probable adjustments). Recourse liabilities have a fair value of 1.00% of receivables factored. ACCOUNTS RECEIVABLE GAIN / LOSS ON SALE OF RECEIVABLES DUE FROM FACTOR RECOURSE LIABILITY + ANSWERS How much cash does Beerbo collect from factoring the receivables? fin $il How much must Beerbo initially record as 'DUE FROM FACTOR' from the transaction? [in $1 Beerbo must recognize a... [gain / loss)... from the transaction How much gain / loss must Beerbo recognize from the transaction? [in $1 How much recourse liability must Beerbo recognize from the transaction? [in $1 How much does GJ. Wentworth record as 'ACCOUNTS RECEIVABLE' from the transaction? [in $1 How much must G.J. Wentworth initially record as 'DUE TO BEERBO' on the transaction? fin $ G.J. Wentworth must recognize interest... (revenue / expense) from the transaction How much interest revenue / expense must G.J. Wentworth recognize from the transaction? fin $1 If GJ. Wentworth collects only $495,000 on account, how much must it remit to Beerbo? fin $1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts