Question: Page 2 Assignment: Go through the following 5 items Prepare Adjusting Journal Entries a. The 3/1/19 Notes Payable principle from First Hawaiian Bank is due

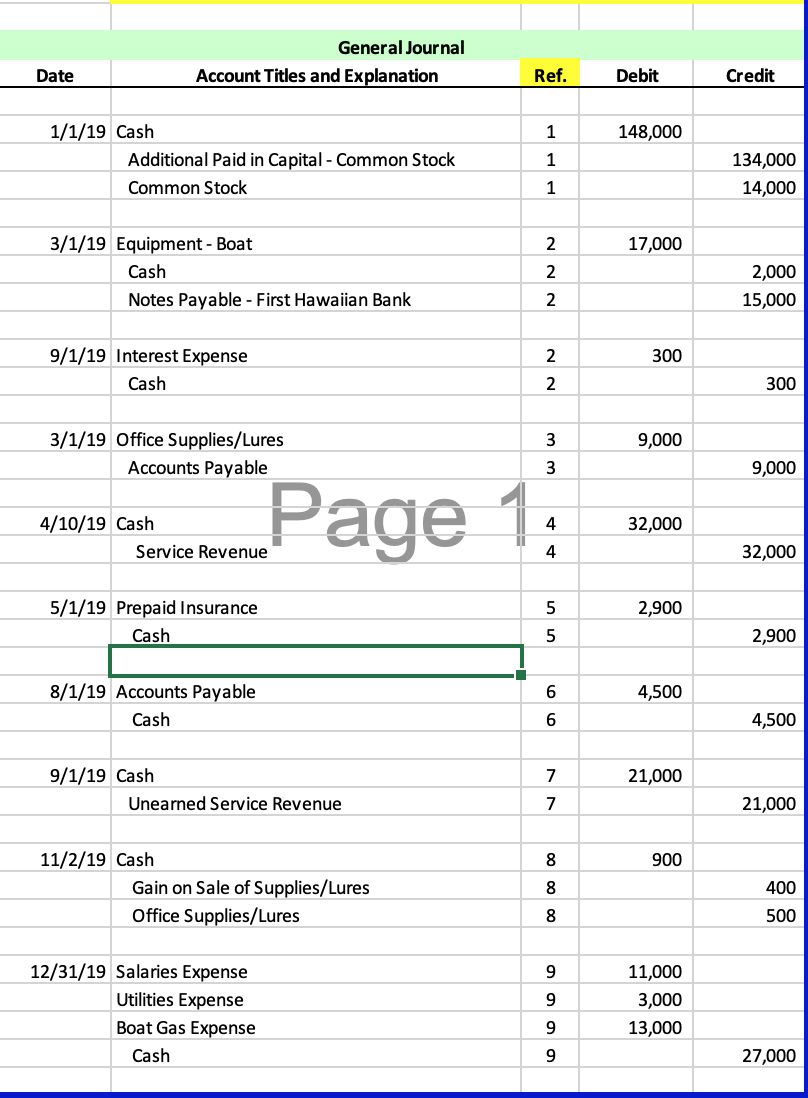

Page 2 Assignment: Go through the following 5 items Prepare Adjusting Journal Entries a. The 3/1/19 Notes Payable principle from First Hawaiian Bank is due in 5 years at an annual interest rate of 4%. Interest must be paid every 6-months. b. The boat purchased on 3/1/19 is depreciated using the straight-line method over a useful life of 9 years. Salvage is zero. C. Du Due to the use of office supplies, the Office Supplies and lures only added up to $100 at the end of the 2019 year. d. Insurance expense was recorded. e. On 12/30/19, 50% of the services were provided early from the customers that paid cash on 9/1/19. General Journal Account Titles and Explanation Date Ref. Debit Credit 148,000 1/1/19 Cash Additional Paid in Capital - Common Stock Common Stock 134,000 14,000 1 17,000 3/1/19 Equipment - Boat Cash Notes Payable - First Hawaiian Bank 2,000 15,000 300 9/1/19 Interest Expense Cash 2 300 9,000 3/1/19 Office Supplies/Lures Accounts Payable 9,000 32,000 4/10/19 Cash Service Revenue 32,000 | 5 | 2,900 5/1/19 Prepaid Insurance Cash 15 2,900 6 4,500 8/1/19 Accounts Payable Cash 4,500 21,000 9/1/19 Cash Unearned Service Revenue NN 21,000 8 900 00 11/2/19 Cash Gain on Sale of Supplies/Lures Office Supplies/Lures 00 400 500 00 0 9 9 12/31/19 Salaries Expense Utilities Expense Boat Gas Expense Cash 11,000 3,000 13,000 9 27,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts