Question: ( page 2 ) , Form 6 2 5 1 , and Form 8 5 8 2 . Do not compute the underpayment penalty, if

page Form and Form Do not compute the underpayment penalty, if any.

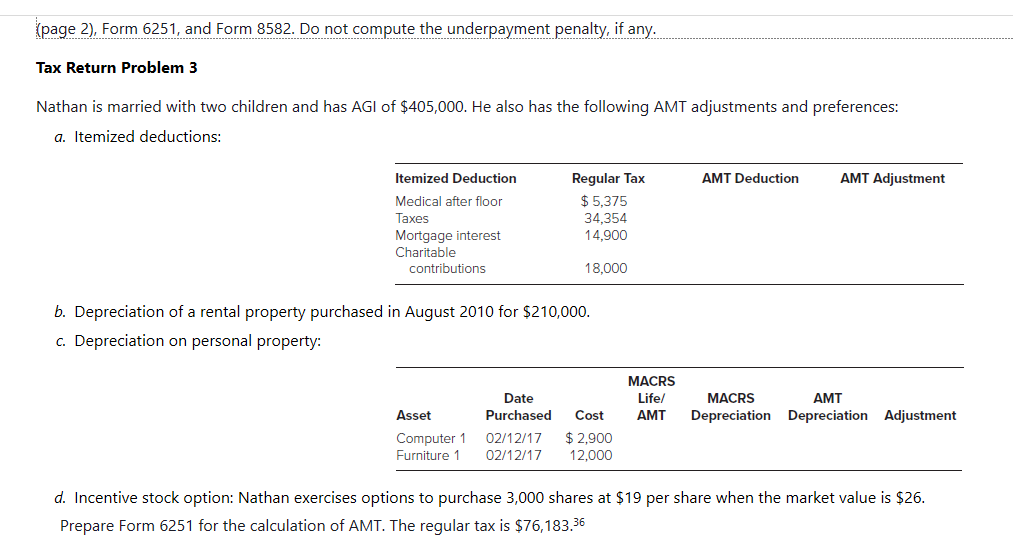

Tax Return Problem

Nathan is married with two children and has AGI of $ He also has the following AMT adjustments and preferences:

a Itemized deductions:

b Depreciation of a rental property purchased in August for $

c Depreciation on personal property:

d Incentive stock option: Nathan exercises options to purchase shares at $ per share when the market value is $

Prepare Form for the calculation of AMT. The regular tax is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock