Question: page 2 is the module 2 reference sheet. income statment and the balance sheet Profit decisions are important to the Martins. These decisions arise from

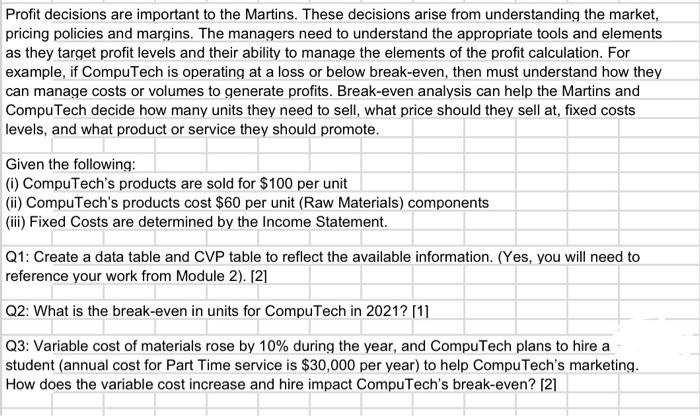

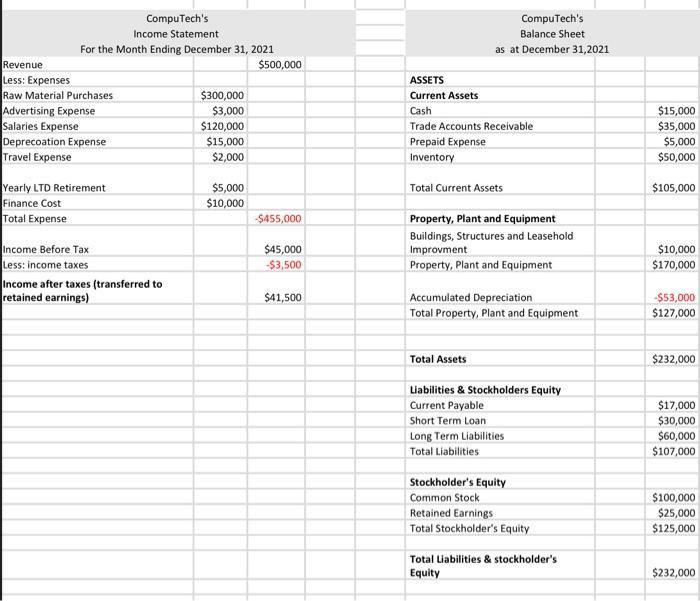

Profit decisions are important to the Martins. These decisions arise from understanding the market, pricing policies and margins. The managers need to understand the appropriate tools and elements as they target profit levels and their ability to manage the elements of the profit calculation. For example, if CompuTech is operating at a loss or below break-even, then must understand how they can manage costs or volumes to generate profits. Break-even analysis can help the Martins and CompuTech decide how many units they need to sell, what price should they sell at, fixed costs levels, and what product or service they should promote. Given the following: (i) CompuTech's products are sold for $100 per unit (ii) CompuTech's products cost $60 per unit (Raw Materials) components (iii) Fixed Costs are determined by the Income Statement Q1: Create a data table and CVP table to reflect the available information. (Yes, you will need to reference your work from Module 2). [2] Q2: What is the break-even in units for CompuTech in 2021? [11 Q3: Variable cost of materials rose by 10% during the year, and CompuTech plans to hire a student (annual cost for Part Time service is $30,000 per year) to help CompuTech's marketing. How does the variable cost increase and hire impact CompuTech's break-even? [21 CompuTech's Balance Sheet as at December 31,2021 CompuTech's Income Statement For the Month Ending December 31, 2021 Revenue $500,000 Less: Expenses Raw Material Purchases $300,000 Advertising Expense $3,000 Salaries Expense $120,000 Deprecoation Expense $15,000 Travel Expense $2,000 ASSETS Current Assets Cash Trade Accounts Receivable Prepaid Expense Inventory $15,000 $35,000 $5,000 $50,000 Total Current Assets $105,000 Yearly LTD Retirement Finance Cost Total Expense $5,000 $10,000 -$455,000 Property, Plant and Equipment Buildings, Structures and Leasehold Improvment Property, Plant and Equipment $45,000 $3,500 Income Before Tax Less: income taxes Income after taxes (transferred to retained earnings) $10,000 $170,000 $41,500 Accumulated Depreciation Total Property, Plant and Equipment -$53,000 $127,000 Total Assets $232,000 Liabilities & Stockholders Equity Current Payable Short Term Loan Long Term Liabilities Total Liabilities $17,000 $30,000 $60,000 $107,000 Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity $100,000 $25,000 $125,000 Total Liabilities & stockholder's Equity $232,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts