Question: Page 2 SECTION A 1. Carefully explain the differences between hedger, speculatorand arbitrager and how they might use forwards/futurescontracts? (10 marks, maximum word counts 300)

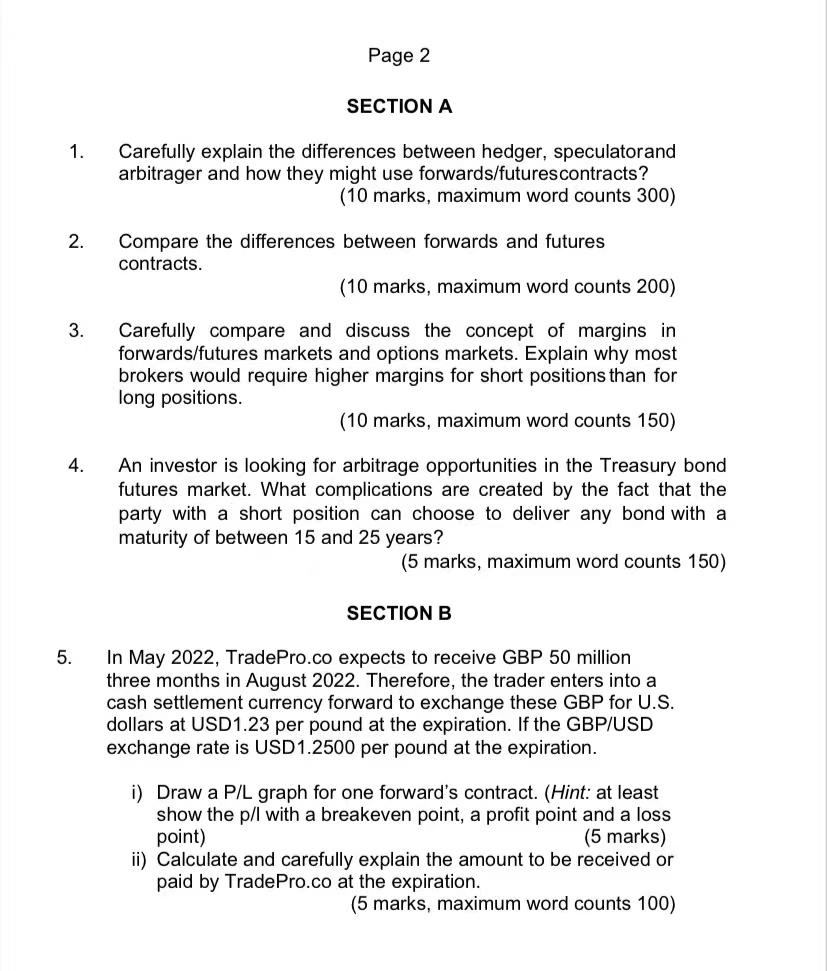

Page 2 SECTION A 1. Carefully explain the differences between hedger, speculatorand arbitrager and how they might use forwards/futurescontracts? (10 marks, maximum word counts 300) 2. Compare the differences between forwards and futures contracts. (10 marks, maximum word counts 200) 3. Carefully compare and discuss the concept of margins in forwards/futures markets and options markets. Explain why most brokers would require higher margins for short positions than for long positions. (10 marks, maximum word counts 150) 4. An investor is looking for arbitrage opportunities in the Treasury bond futures market. What complications are created by the fact that the party with a short position can choose to deliver any bond with a maturity of between 15 and 25 years? (5 marks, maximum word counts 150) SECTION B 5. In May 2022, TradePro.co expects to receive GBP 50 million three months in August 2022. Therefore, the trader enters into a cash settlement currency forward to exchange these GBP for U.S. dollars at USD1.23 per pound at the expiration. If the GBP/USD exchange rate is USD 1.2500 per pound at the expiration. i) Draw a P/L graph for one forward's contract. (Hint: at least show the p/l with a breakeven point, a profit point and a loss point) (5 marks) ii) Calculate and carefully explain the amount to be received or paid by TradePro.co at the expiration. (5 marks, maximum word counts 100) Page 2 SECTION A 1. Carefully explain the differences between hedger, speculatorand arbitrager and how they might use forwards/futurescontracts? (10 marks, maximum word counts 300) 2. Compare the differences between forwards and futures contracts. (10 marks, maximum word counts 200) 3. Carefully compare and discuss the concept of margins in forwards/futures markets and options markets. Explain why most brokers would require higher margins for short positions than for long positions. (10 marks, maximum word counts 150) 4. An investor is looking for arbitrage opportunities in the Treasury bond futures market. What complications are created by the fact that the party with a short position can choose to deliver any bond with a maturity of between 15 and 25 years? (5 marks, maximum word counts 150) SECTION B 5. In May 2022, TradePro.co expects to receive GBP 50 million three months in August 2022. Therefore, the trader enters into a cash settlement currency forward to exchange these GBP for U.S. dollars at USD1.23 per pound at the expiration. If the GBP/USD exchange rate is USD 1.2500 per pound at the expiration. i) Draw a P/L graph for one forward's contract. (Hint: at least show the p/l with a breakeven point, a profit point and a loss point) (5 marks) ii) Calculate and carefully explain the amount to be received or paid by TradePro.co at the expiration. (5 marks, maximum word counts 100)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts