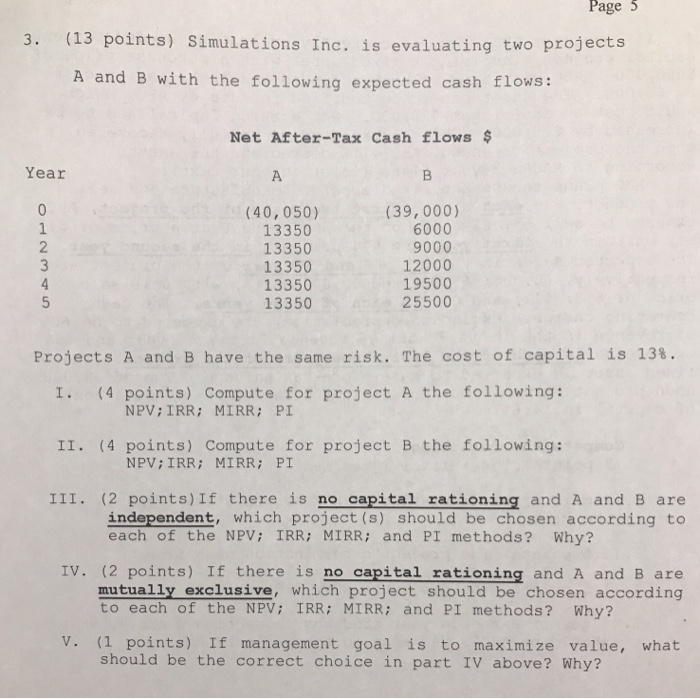

Question: Page 3. (13 points) Simulations Inc. is evaluating two projects A and B with the following expected cash flows: Net After-Tax Cash flows $ Year

Page 3. (13 points) Simulations Inc. is evaluating two projects A and B with the following expected cash flows: Net After-Tax Cash flows $ Year (40,050) 13350 13350 13350 13350 13350 (39,000) 6000 9000 12000 19500 25500 2 Projects A and B have the same risk. The cost of capital is 13%. I. (4 points) Compute for project A the following: NPV: IRR; MIRR PI II. (4 points) Compute for project B the following: NPV: IRR ; MIRR ; PI III. (2 points)If there is no capital rationing and A and B are independent, which project (s) should be chosen according to each of the NPV: IRR; MIRR; and PI methods? Why? IV. (2 points) If there is no capital rationing and A and B are mutually exclusive, which project should be chosen according to each of the NPV: IRR: MIRR: and PI methods? Why? V. (1 points) If management goal is to maximize value, what should be the correct choice in part IV above? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts