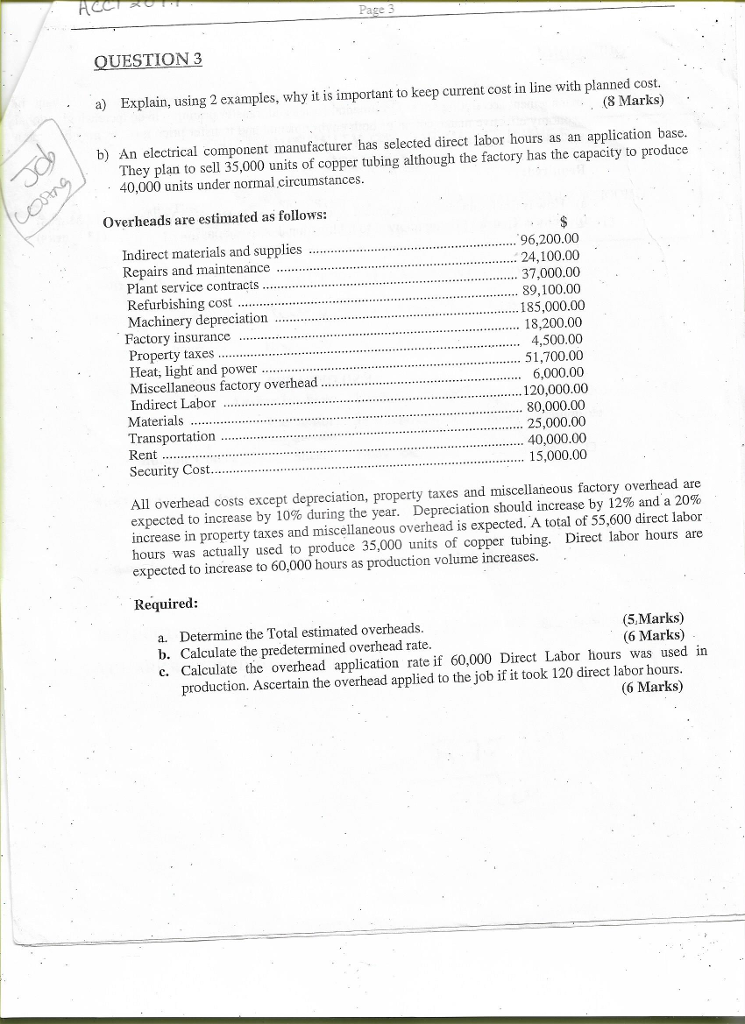

Question: Page 3 STION 3 .a) Explain, using 2 examples, why it is important to keep current cost in line with planned cost. (8 Marks) b)

Page 3 STION 3 .a) Explain, using 2 examples, why it is important to keep current cost in line with planned cost. (8 Marks) b) An elcctrical component manufacturer has selected direct labor hours as an application base. They plan to sell 35,000 units of copper tubing although the factory has the capacity to produce 40,000 units under normal circumstances Overheads are estimated as follows: Indirect materials and supplies Repairs and maintenance Plant service contracts Refurbishing cost Machinery depreciation Factory insurance Property taxes 96,200.00 24,100.00 37,000.00 89,100.00 185,000.00 18,200.00 4,500.00 51,700.00 6,000.00 .120,000.00 80,000.00 25,000.00 40,000.00 15,000.00 Heat, light and power.. Miscellaneous factory overhead Indirect Labor Materials.... Transportation Security Cost All overhead costs except depreciation, property taxes and miscellaneous factory overhead are expected to increase by 10% during the year. Depreciation should increase by 12% and a 20% increase in property taxes and miscellaneous overhead is expected. A total of 55,600 direct labor hours was actually used to produce 35,000 units of copper tubing. Direct labor hours are expected to increase to 60,000 hours as production volume increases. Required: a. Determine the Total estimated overheads b. Calculate the predetermined overhead rate. c. Calculate the overhead application rate if 60,000 Direct Labor hours was used irn (5.Marks) (6 Marks) production. Ascertain the overhead applied to the job if it took 120 direct labor hours (6 Marks) Page 3 STION 3 .a) Explain, using 2 examples, why it is important to keep current cost in line with planned cost. (8 Marks) b) An elcctrical component manufacturer has selected direct labor hours as an application base. They plan to sell 35,000 units of copper tubing although the factory has the capacity to produce 40,000 units under normal circumstances Overheads are estimated as follows: Indirect materials and supplies Repairs and maintenance Plant service contracts Refurbishing cost Machinery depreciation Factory insurance Property taxes 96,200.00 24,100.00 37,000.00 89,100.00 185,000.00 18,200.00 4,500.00 51,700.00 6,000.00 .120,000.00 80,000.00 25,000.00 40,000.00 15,000.00 Heat, light and power.. Miscellaneous factory overhead Indirect Labor Materials.... Transportation Security Cost All overhead costs except depreciation, property taxes and miscellaneous factory overhead are expected to increase by 10% during the year. Depreciation should increase by 12% and a 20% increase in property taxes and miscellaneous overhead is expected. A total of 55,600 direct labor hours was actually used to produce 35,000 units of copper tubing. Direct labor hours are expected to increase to 60,000 hours as production volume increases. Required: a. Determine the Total estimated overheads b. Calculate the predetermined overhead rate. c. Calculate the overhead application rate if 60,000 Direct Labor hours was used irn (5.Marks) (6 Marks) production. Ascertain the overhead applied to the job if it took 120 direct labor hours (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts