Question: Page 4 of6 Section A: Tax Case Studies Case study (1) (10 Marks) For the current year, Creative Designs Inc., a C corporation, reports taxable

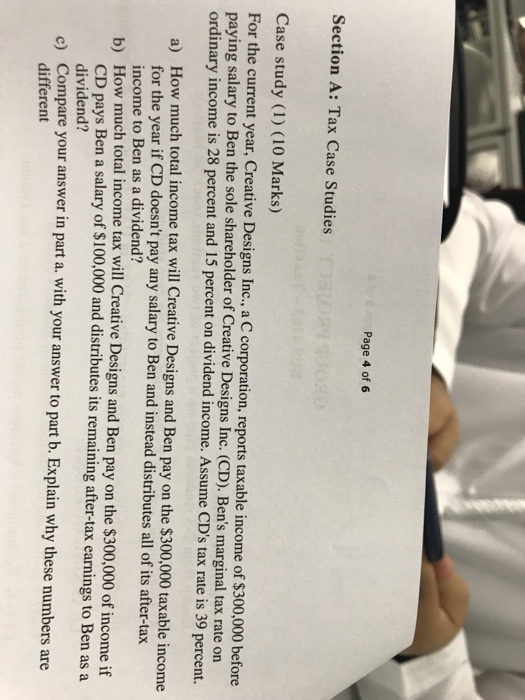

Page 4 of6 Section A: Tax Case Studies Case study (1) (10 Marks) For the current year, Creative Designs Inc., a C corporation, reports taxable income of paying salary to Ben the sole shareholder of Creative Designs Ii ordinary income is 28 percent and 15 percent on dividend income. Assume CD's tax rate w much total income tax will Creative Designs and Ben pay on the $300,000 taxable income for the year if CD doesn't pay any salary to Ben and instead distributes all of its after-tax income to Ben as a dividend? How much total income CD pays Ben a salary of $100,000 and distributes its remaining after-tax earnings to Ben as a dividend? Compare your answer in part a. with your answer to part b. Explain why these numbers are different a) Ho b) c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts