Question: Page 4 ting 2101/6101-Additional exercises-Chapter 6 and Chapter 7 12) The Tenderloin Company plans to build a new factory in five years, at an expected

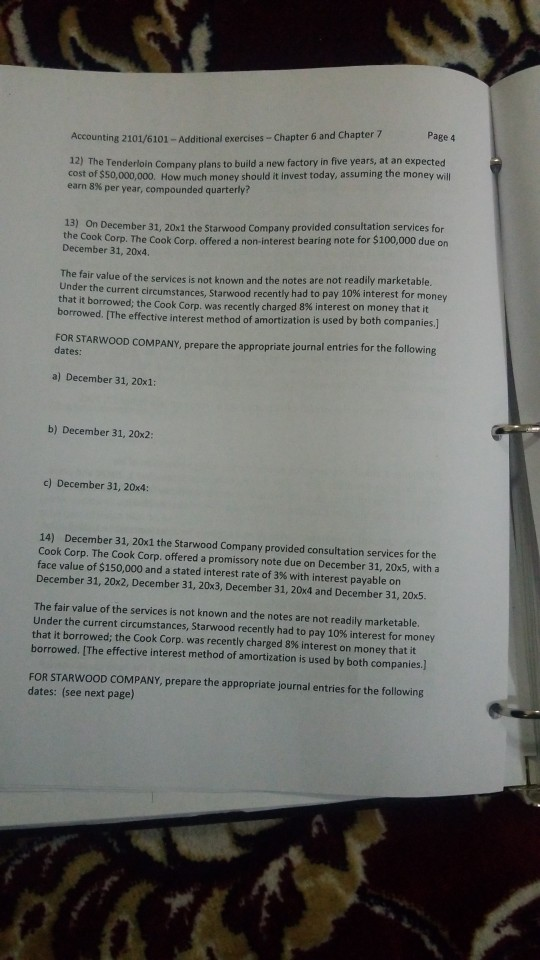

Page 4 ting 2101/6101-Additional exercises-Chapter 6 and Chapter 7 12) The Tenderloin Company plans to build a new factory in five years, at an expected cost of $50,000,000. How much money should it invest today, assuming the money will earn 8% per year, compounded quarterly? 13) On December 31, 20x1 the Starwood Company provided consultation services for the Cook Corp. The Cook Corp, offered a non-interest bearing note for $100,000 due on December 31, 20x4. e fair value o the services is not known and the notes are not readily marketable Under the current ci that it borrow borrowed. [The effective interest method of amortization is used by both companies] rc umst ances, Starwood recently had to pay 10% interest for money ed; the Cook Corp. was recently charged 8% interest on money that it FOR STARWOOD COMPANY, prepare the appropriate journal entries for the following dates: a) December 31, 20x1: b) December 31, 20x2: c) December 31, 20x4: 14) December 31, 20x1 the Starwood Company provided consultation services for the Cook Corp. The Cook Corp. offered a promissory note due on December 31, 20x5, with a face value of $150,000 and a stated interest rate of 3% with interest payable on December 31, 20x2, December 31, 20x3, December 31, 20x4 and December 31, 20x5. The fair value of the services is not known and the notes are not readily marketable. Under the current circumstances, Starwood recently had to pay 10% interest for money that it borrowed; the Cook Corp. was recently charged 8% interest on money that it borrowed. [The effective interest method of amortization is used by both companies.] FOR STARWOOD COMPANY, prepare the appropriate journal entries for the following dates: (see next page)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts