Question: Page 6 0 2 Exercise 1 5 - 1 7 Overhead rate; costs assigned to jobs Shire Company's predetermined overhead rate is based on direct

Page

Exercise Overhead rate; costs assigned to jobs

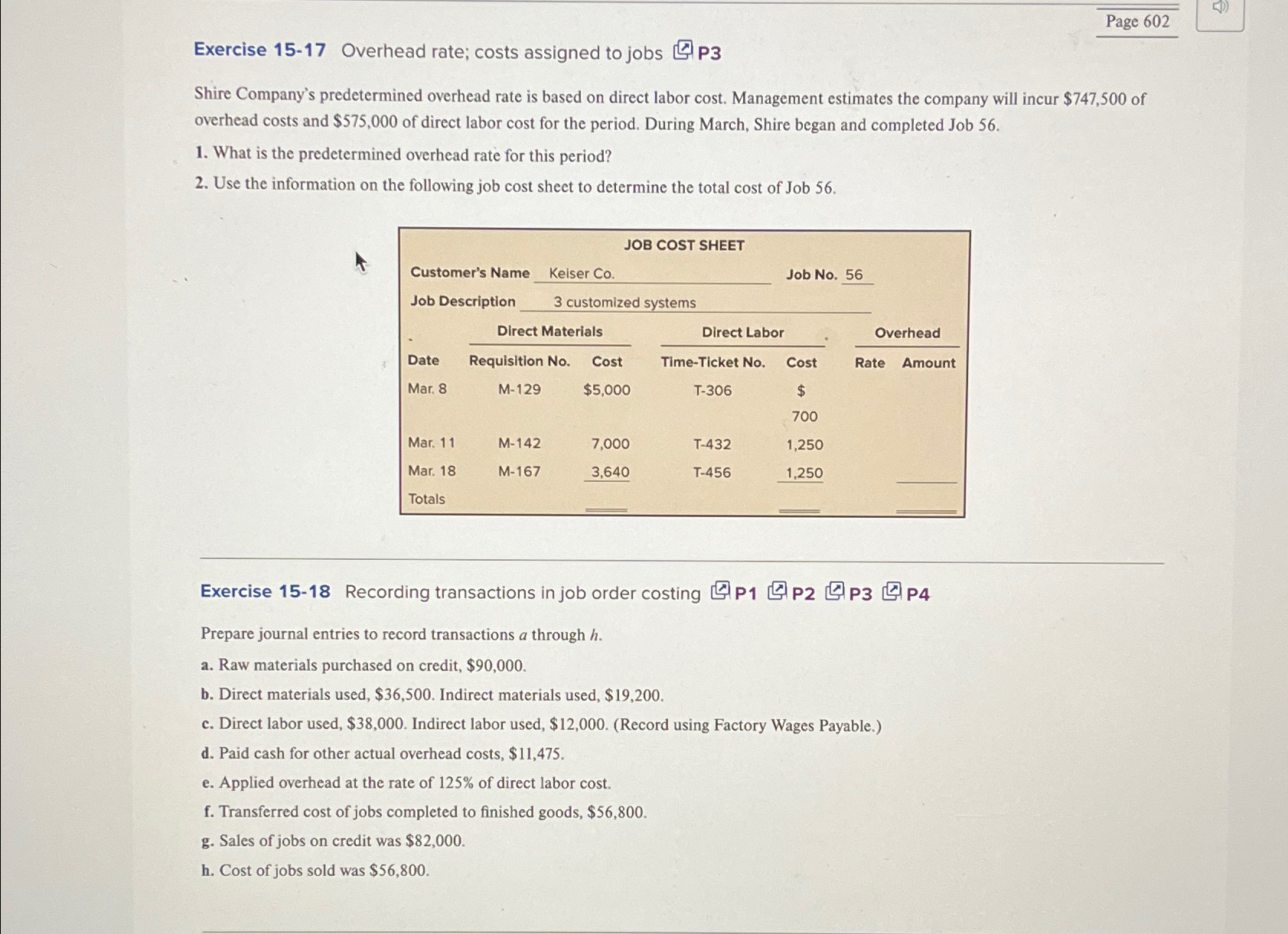

Shire Company's predetermined overhead rate is based on direct labor cost. Management estimates the company will incur $ of overhead costs and $ of direct labor cost for the period. During March, Shire began and completed Job

What is the predetermined overhead rate for this period?

Use the information on the following job cost sheet to determine the total cost of Job

JOB COST SHEET

Customer's Name Keiser Co Job No Job Description customized systems

tableDateDirect Materials,Direct Labor,OverheadRequisition NoCost,TimeTicket NoCost,Rate,AmountMarM$T$MarMarTotals

Exercise Recording transactions in job order costing

Prepare journal entries to record transactions a through

a Raw materials purchased on credit, $

b Direct materials used, $ Indirect materials used, $

c Direct labor used, $ Indirect labor used, $Record using Factory Wages Payable.

d Paid cash for other actual overhead costs, $

e Applied overhead at the rate of of direct labor cost.

f Transferred cost of jobs completed to finished goods, $

g Sales of jobs on credit was $

h Cost of jobs sold was $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock