Question: Page 700 Problem 17-4B Using departmental overhead rate method to compute overhead cost per unit, product cost per unit, and gross profit per unit p2

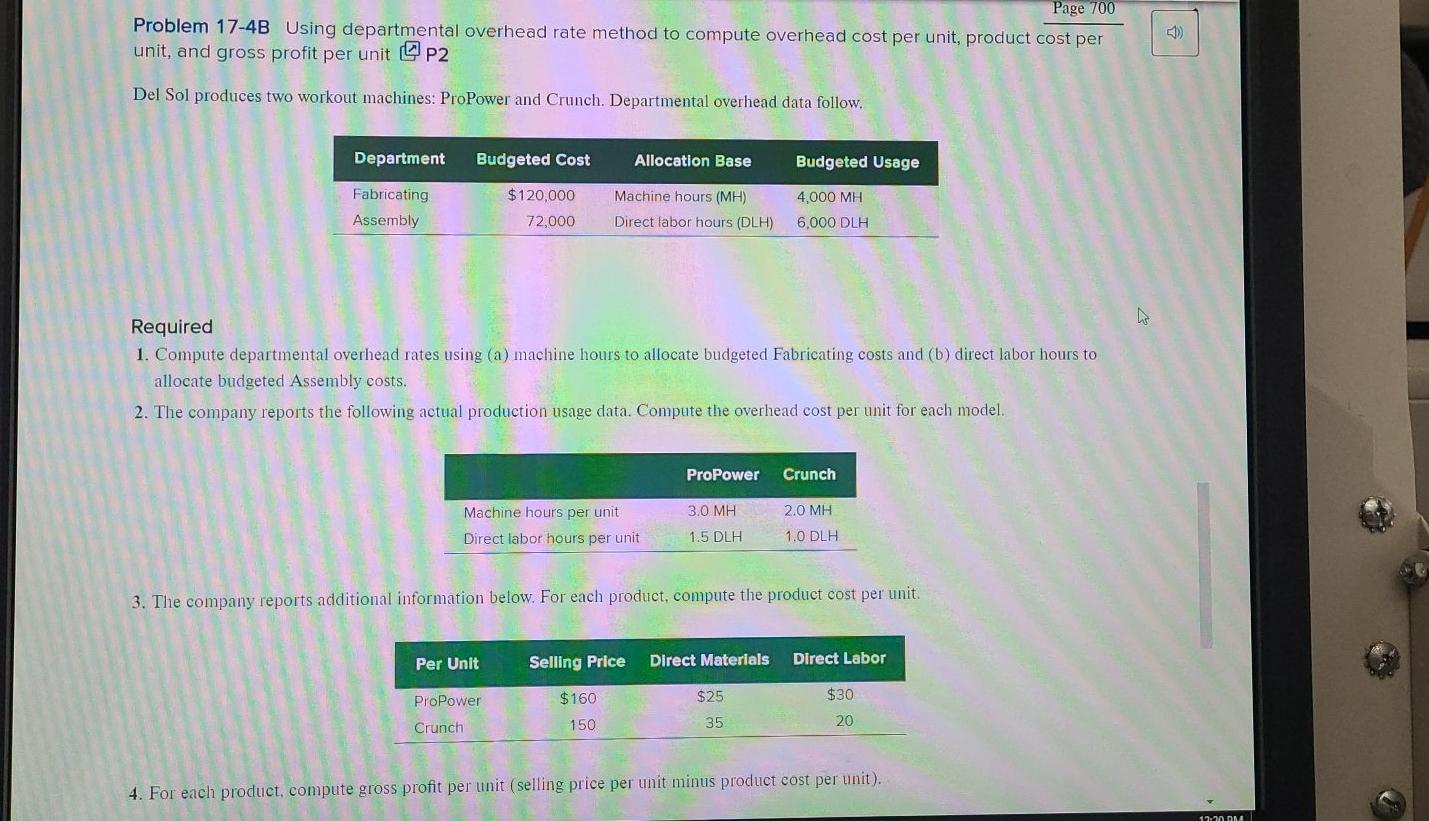

Page 700 Problem 17-4B Using departmental overhead rate method to compute overhead cost per unit, product cost per unit, and gross profit per unit p2 Del Sol produces two workout machines: ProPower and Crunch. Departmental overhead data follow. Department Budgeted Cost Allocation Base Budgeted Usage Fabricating Assembly $120,000 72,000 Machine hours (MH) Direct labor hours (DLH) 4,000 MH 6,000 DLH Required 1. Compute departmental overhead rates using (a) machine hours to allocate budgeted Fabricating costs and (b) direct labor hours to allocate budgeted Assembly costs. 2. The company reports the following actual production usage data. Compute the overhead cost per unit for each model. ProPower Crunch 3.0 MH 2.0 MH Machine hours per unit Direct labor hours per unit 1.5 DLH 1.0 DLH 3. The company reports additional information below. For each product, compute the product cost per unit. Per Unit Selling Price Direct Materials Direct Labor $160 $25 $30 ProPower Crunch 150 35 20 4. For each product, compute gross profit per unit (selling price per unit minus product cost per unit). 17:20 ML

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts