Question: Page view + A Read oud m Add textDraw Highlight Assignment 14 The purpose of this assignment is to solidify your understanding on the capital

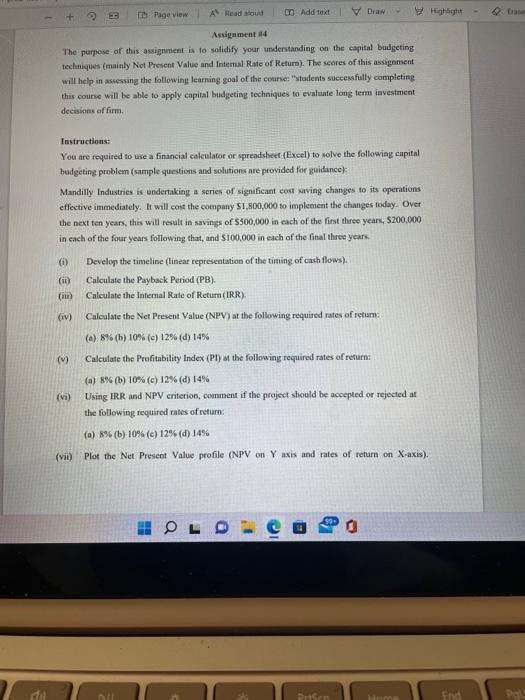

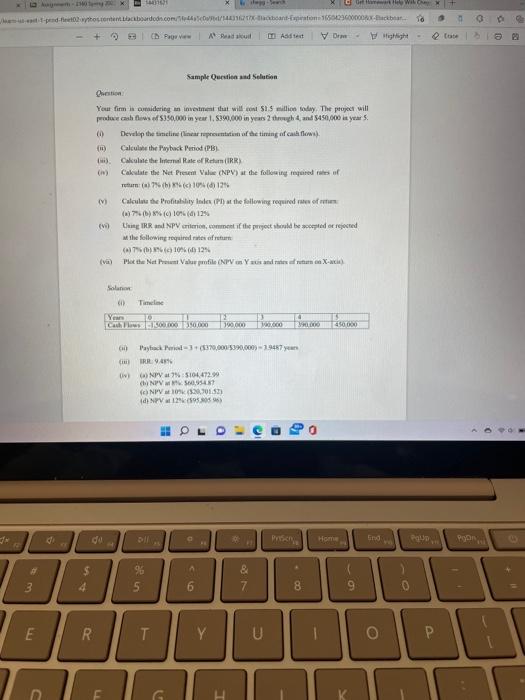

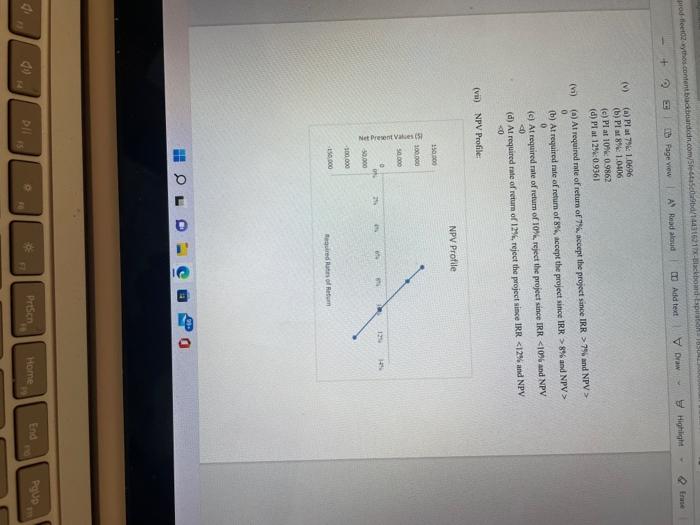

Page view + A Read oud m Add textDraw Highlight Assignment 14 The purpose of this assignment is to solidify your understanding on the capital budgeting techniques (mainly Net Present Value and Intemal Rate of Return). The scores of this assignment will help in assessing the following learning goal of the coun: "Students successfully completing this course will be able to apply capital budgeting techniques to evaluate long term investment decisions of firm. Instructions: You are required to use a financial calculator or spreadsheet (Excel) to solve the following capital budgeting problem (sample questions and solutions are provided for guidance) Mandilly Industries is undertaking a series of significant cost saving changes to its operations effective immediately. It will cost the company S1,800,000 to implement the changes today. Over the next ten years, this will result in savings of $500,000 in each of the first three years, $200,000 in each of the four years following that, and $100,000 in each of the final three years. 6) (10) ( (iv) Develop the timeline linear representation of the timing of cash flows). Calculate the Payback Period (PB). Calculate the Internal Rate of Return(IRR). Calculate the Net Present Value (NPV) at the following required rates of retum (a) 8% (b) 10% (c) 12% (d) 14% Calculate the Profitability Index (PT) at the following required rates of return (a) 8% (b) 10% (c) 12% (d) 14% Using IRR and NPV criterion, comment if the project should be accepted or rejected at the following required rates of retum (V) (vi) (a) 8% (b) 10% (c) 129(d) 14% (vii) Plot the Net Present Value profile (NPV on Y axis and rates of return on X-axis). OLD 10 O OWN 10 3 upendo.boardon.com/tom. + 3 Padaku m Add text D- Highlight e totes Sample Question and Solution You fimm midering an investment but will cont 1 million today. The project will pale cash flows of 350.000 in year 1.390.000 in years and $450,000 it year 5. (0) Develop the timeline linear reputation of the timang of califow) m) Calculate the Payback Period (PB) Calcolate the Internal Rate of Return (IRR) Calculate the Net Presem Value (NPV) at the following required rates of return(7.10(125 ( Calculate the Profitability Index (P) at the following required from (N) 10% (6) 125 VO Chip TRR and NPV criterion, comment if the project heeld be copied or rejooned Mthe following required rates of return 0710760125 (vin the Net Valpole (NPVYeturn X-cit) Solano Timeline Ya Como www.see on Telcome to con Payback 3370,0015390.0003 - 1947 IRRL94 Uw) NPV 5104,472.99 CNP54 (NPV (20.301521 INV150) . o 9 Prison HO End POUD POON $ & Rin 3 5 6 7 8 E R T > Y U o G Highlight osteczythos content badboarded.com/se/144316317-Backbond-ABUL + DB Page View A Read aloud Add text V Draw 3 (1) () P179: 1.0696 (b) PI 861.0406 (c) PI at 104 0.9862 (d) PT at 120.9361 (a) At required rate of return of 7%, accept the project since IRR > 7% and NPV > 0 (h) At required rate of return of 8% accept the project site IRR >8% and NPV > 0 (c) At required rate of retum of 10%,reject the project since IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts