Question: (20 marks) Alexander Ltd entered an operating lease with Swazis Ltd on 01 January 2019. The lease was overa plant (which Alexander Ltd had

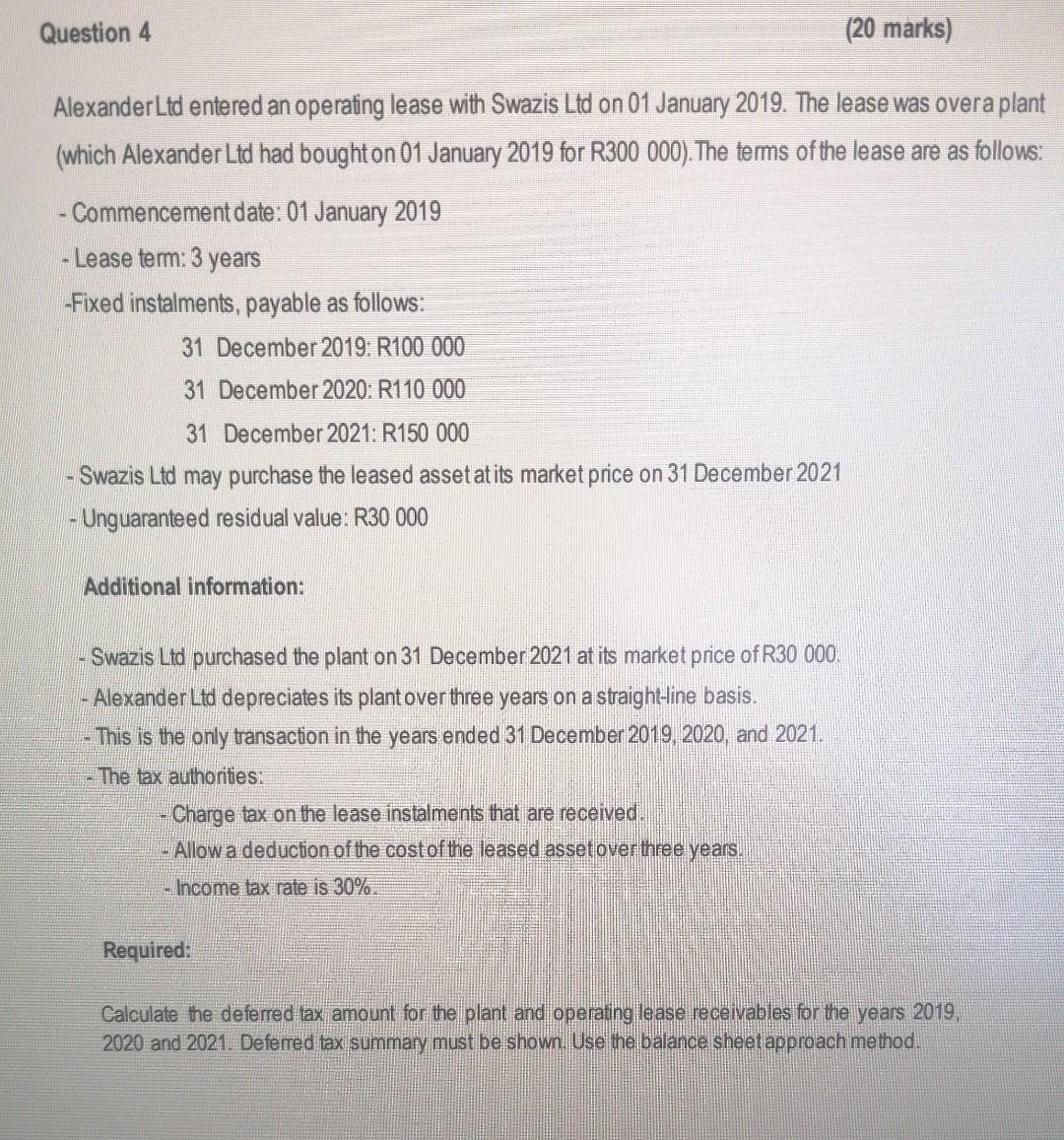

(20 marks) Alexander Ltd entered an operating lease with Swazis Ltd on 01 January 2019. The lease was overa plant (which Alexander Ltd had bought on 01 January 2019 for R300 000). The terms of the lease are as follows: Question 4 - Commencement date: 01 January 2019 - Lease term: 3 years -Fixed instalments, payable as follows: 31 December 2019: R100 000 31 December 2020: R110 000 31 December 2021: R150 000 -Swazis Ltd may purchase the leased asset at its market price on 31 December 2021 - Unguaranteed residual value: R30 000 Additional information: Swazis Ltd purchased the plant on 31 December 2021 at its market price of R30 000. Alexander Ltd depreciates its plant over three years on a straight-line basis. This is the only transaction in the years ended 31 December 2019, 2020, and 2021. -The tax authorities: Charge tax on the lease instalments that are received Allow a deduction of the cost of the leased asset over three years. -Income tax rate is 30%. Required: Calculate the deferred tax amount for the plant and operating lease receivables for the years 2019, 2020 and 2021. Deferred tax summary must be shown. Use the balance sheet approach method.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Question 1 20 marks The following is a trial balance of Alexander Ltd as at 31 December 2021 Debit Credit Cash R 1 200 000 Accounts receivable 800 000 Inventories 1 500 000 Property plant and equipmen... View full answer

Get step-by-step solutions from verified subject matter experts