Question: Panel 1 : The IS - LM Model Intert Rate Panel 2 : The Phillips Curve ( E pi is Expected Inflation ) I Panel

Panel : The ISLM Model

Intert

Rate

Panel : The Phillips Curve E pi is Expected Inflation

I

Panel : Aggregate Demand Aggregate Supply Model

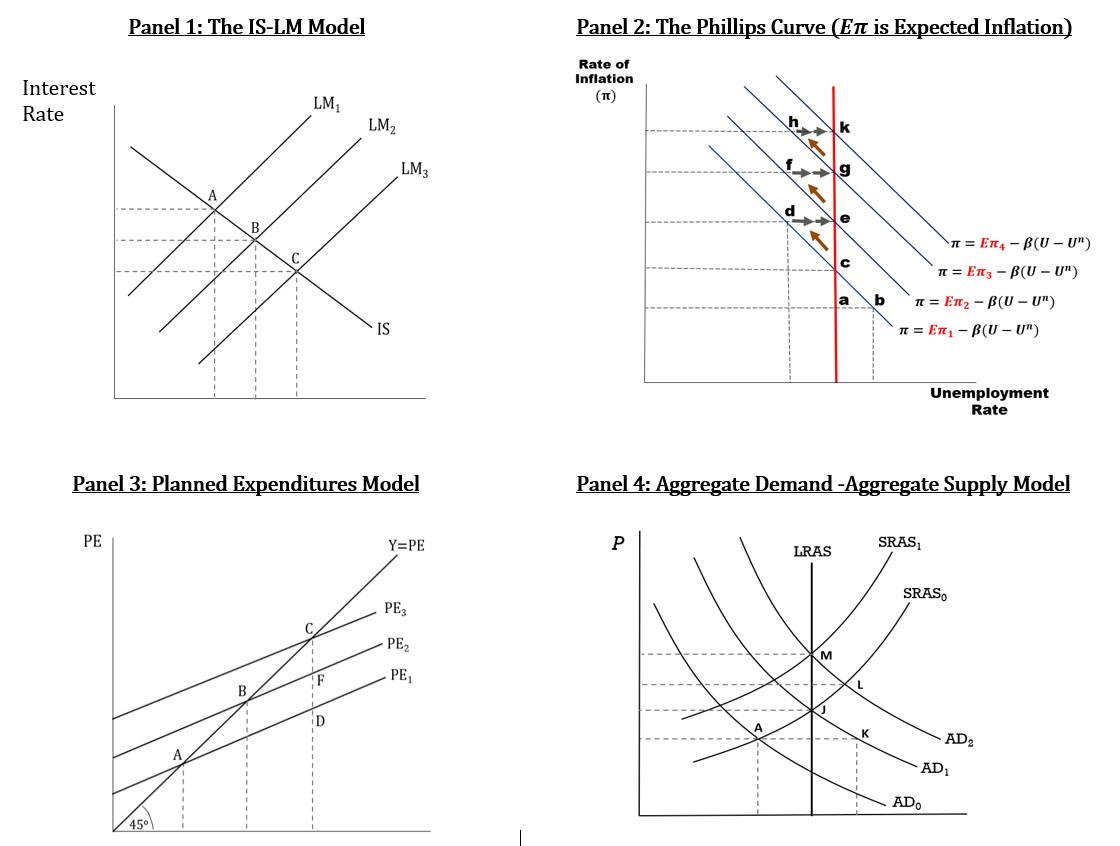

Part : At the original equilibrium at point A with interest rates at expected inflation at E andactualinflation at the economy is: is in a shortrun equilibrium with recessionary gap.is in a shortrun equilibrium with inflationary gap.is in a longrun equilibrium.has no output gaps because the rate of inflation is low.is showing evidence of stagflation.is in a shortrun equilibrium with recessionary gap.

Part : From the original equilibrium at point A suppose an expansionary monetary policy shifts the LM curve to LM and reduces interest rates to The policy affects Planned Expenditure by: reducing consumption expenditures, business investment expenditures, and net exports.raising consumption expenditures and business investment expenditures, but reducing net exports.raising consumption expenditures, business investment expenditures, and net exports.temporarily reducing inflation expectations to encourage more business investments.reducing consumption expenditures, business investment expenditures, and net exports.

Part : In Panel if the public's inflationary expectations is Eand actual inflation is at : actual unemployment is at actual unemployment is at actual unemployment is at actual unemployment can be at or actual unemployment can be at or

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock