Question: Par BAT CA BAT 26 . * Col We| car | Car | Car| Car al Car Inv | IN | AC | FIN |

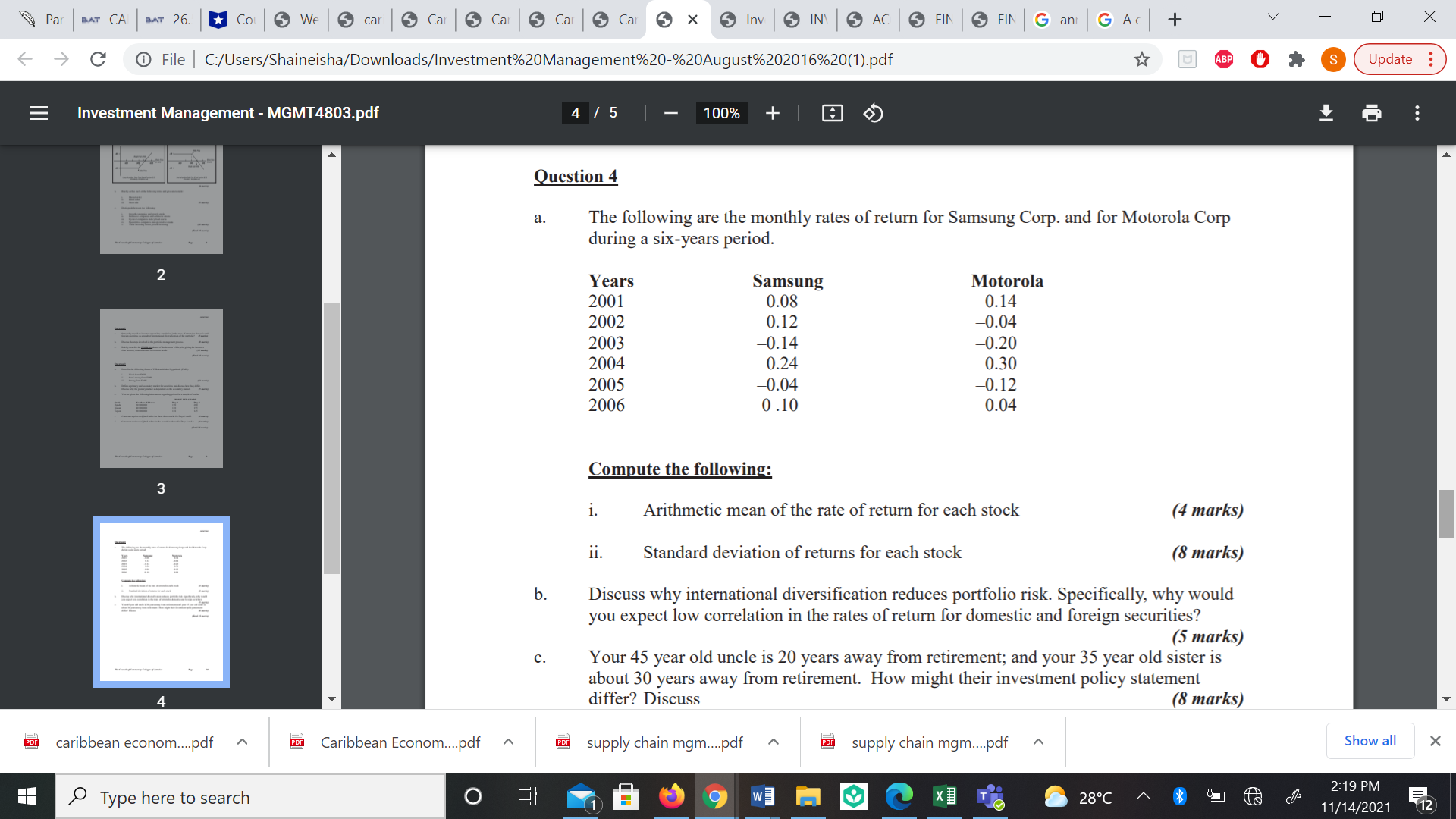

Par BAT CA BAT 26 . * Col We| car | Car | Car| Car al Car Inv | IN | AC | FIN | FIN G an G Ac + V X C @ File | C:/Users/Shaineisha/Downloads/Investment%20Management%20-%20August%202016%20(1).pdf ABP S Update E Investment Management - MGMT4803.pdf 4 / 5 100% + Question 4 a. The following are the monthly rates of return for Samsung Corp. and for Motorola Corp during a six-years period. 2 Years Samsung Motorola 2001 0.08 0.14 2002 0.12 -0.04 2003 -0.14 -0.20 2004 0.24 0.30 2005 -0.04 0.12 2006 0.10 0.04 Compute the following: 3 i. Arithmetic mean of the rate of return for each stock (4 marks) ii. Standard deviation of returns for each stock (8 marks) b. Discuss why international diversification reduces portfolio risk. Specifically, why would you expect low correlation in the rates of return for domestic and foreign securities? (5 marks) C. Your 45 year old uncle is 20 years away from retirement; and your 35 year old sister is about 30 years away from retirement. How might their investment policy statement differ? Discuss (8 marks) PDF caribbean econom....pdf Caribbean Econom..pdf PDF supply chain mgm...pdf supply chain mgm...pdf Show all X Type here to search O EM 2:19 PM 28.C 11/14/2021 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts