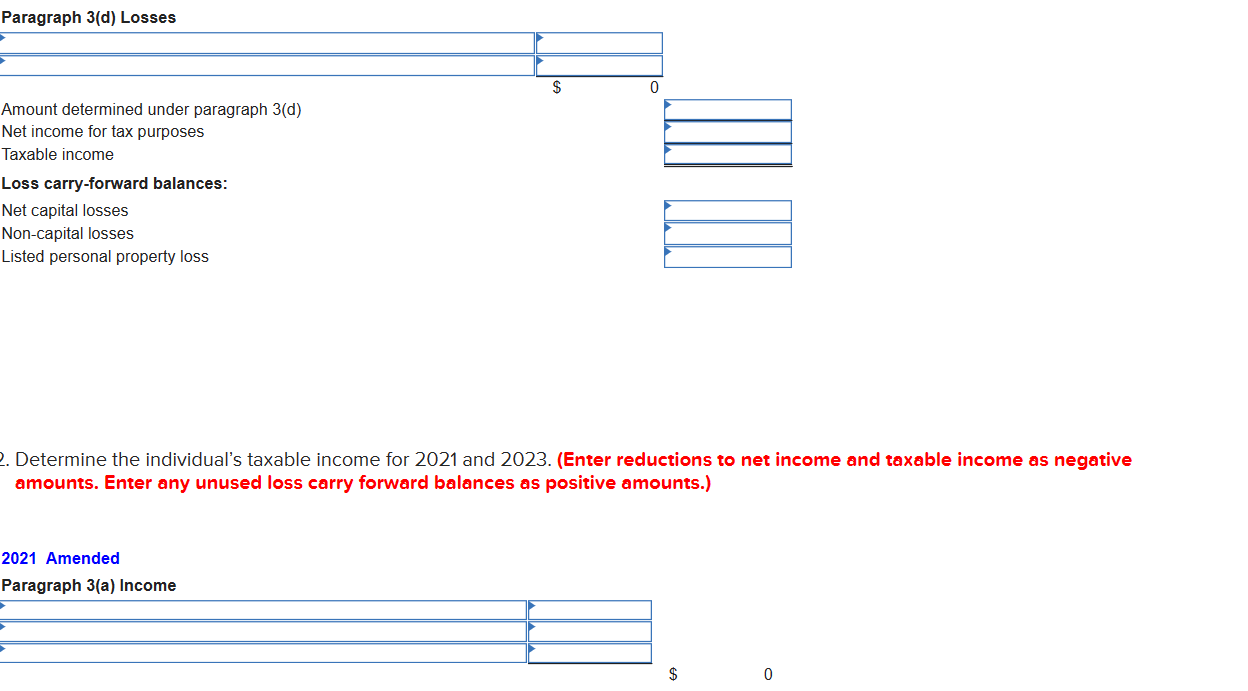

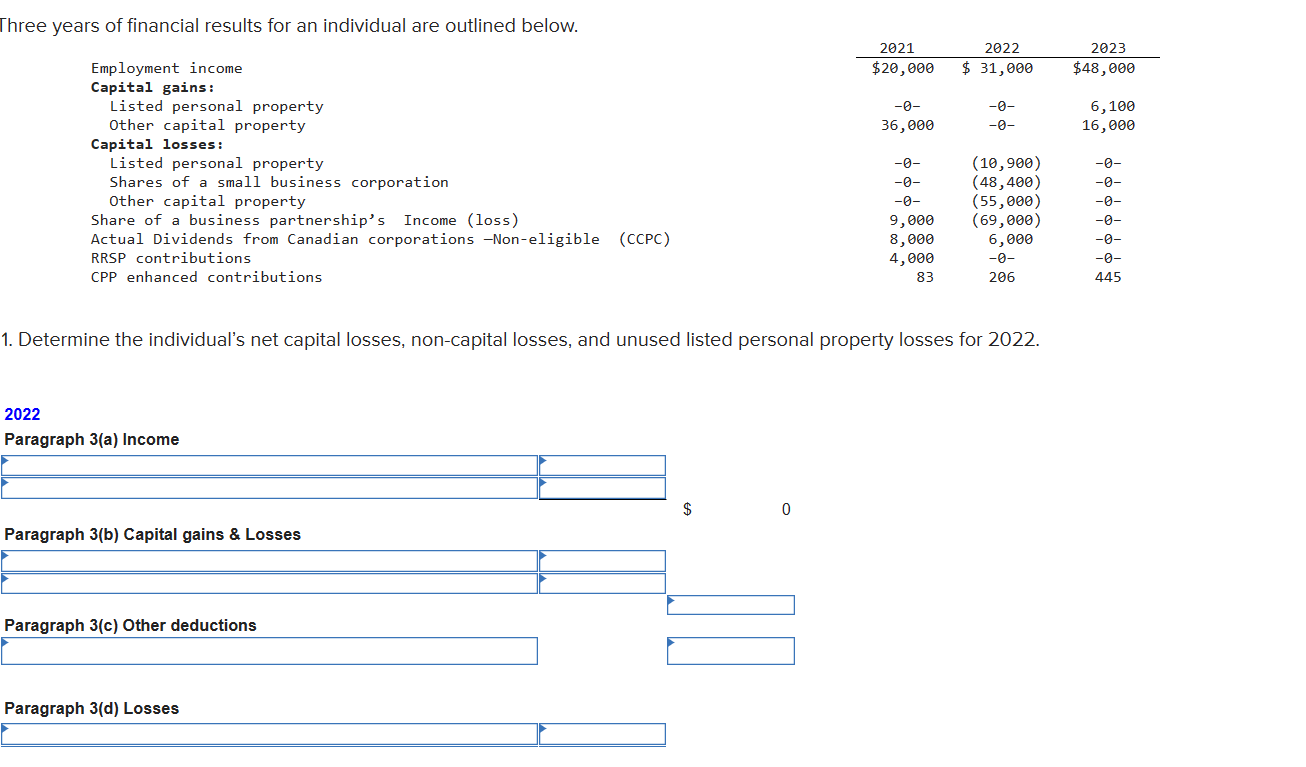

Question: Paragraph 3(d) Losses * r ' g $ 0 Amount determined under paragraph 3(d) F _ # Net Income for tax purposes . Taxable Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts