Question: Paragraph Normal No Spacing Heading 1 Replace Dicta Select Styles Editing Voice Chairman Insurance Company Limited has been in business for several years making

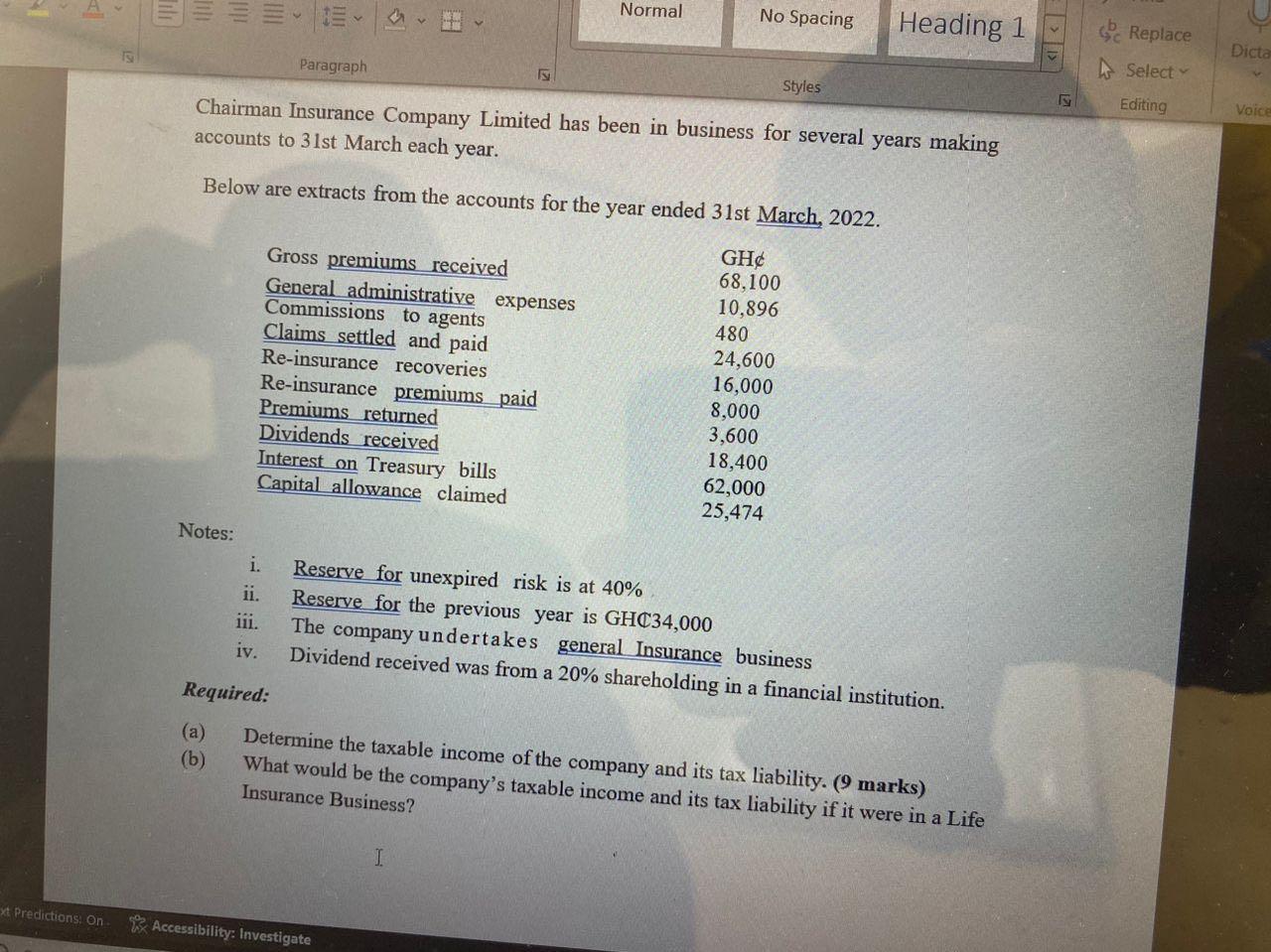

Paragraph Normal No Spacing Heading 1 Replace Dicta Select Styles Editing Voice Chairman Insurance Company Limited has been in business for several years making accounts to 31st March each year. Below are extracts from the accounts for the year ended 31st March, 2022. GH Gross premiums received 68,100 General administrative expenses 10,896 Commissions to agents 480 Claims settled and paid 24,600 Re-insurance recoveries 16,000 Re-insurance premiums paid 8,000 Premiums returned 3,600 Dividends received 18,400 Interest on Treasury bills 62,000 Capital allowance claimed 25,474 Notes: i. Reserve for unexpired risk is at 40% ii. 111. iv. Required: (a) (b) Reserve for the previous year is GHC34,000 The company undertakes general Insurance business Dividend received was from a 20% shareholding in a financial institution. Determine the taxable income of the company and its tax liability. (9 marks) What would be the company's taxable income and its tax liability if it were in a Life Insurance Business? I xt Predictions: On Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

To determine the taxable income of Chairman Insurance Company Limited for the year ended 31st March ... View full answer

Get step-by-step solutions from verified subject matter experts