Question: Paragraph Styles QUESTION 1 (27 marks) All transactions below relate to Parsons Builders Company's doubtful accounts for the fiscal year ended June 30, 2021. Parsons

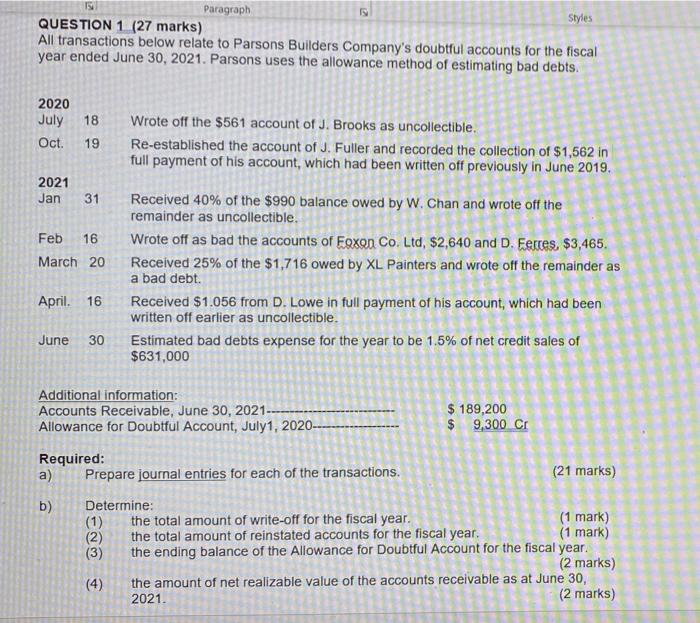

Paragraph Styles QUESTION 1 (27 marks) All transactions below relate to Parsons Builders Company's doubtful accounts for the fiscal year ended June 30, 2021. Parsons uses the allowance method of estimating bad debts. 2020 July Oct. 18 19 Wrote off the $561 account of J. Brooks as uncollectible. Re-established the account of J. Fuller and recorded the collection of $1,562 in full payment of his account, which had been written off previously in June 2019. 2021 Jan 31 16 Feb March 20 Received 40% of the $990 balance owed by W. Chan and wrote off the remainder as uncollectible. Wrote off as bad the accounts of Foxon Co. Ltd, $2,640 and D. Ferres. $3,465. Received 25% of the $1,716 owed by XL Painters and wrote off the remainder as a bad debt. Received $1.056 from D. Lowe in full payment of his account, which had been written off earlier as uncollectible. Estimated bad debts expense for the year to be 1.5% of net credit sales of $631,000 April. 16 June 30 Additional information: Accounts Receivable, June 30, 2021- Allowance for Doubtful Account, July1, 2020- $ 189,200 $ 9,300 C Required: a) Prepare journal entries for each of the transactions. (21 marks) b) Determine: (1) the total amount of write-off for the fiscal year. (1 mark) (2) the total amount of reinstated accounts for the fiscal year. (1 mark) (3) the ending balance of the Allowance for Doubtful Account for the fiscal year. (2 marks) (4) the amount of net realizable value of the accounts receivable as at June 30, 2021. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts