Question: Parent and Sub are filing a consolidated return for 2 0 2 3 . They also filed a consolidated return in 2 0 2 2

Parent and Sub are filing a consolidated return for They also filed a consolidated return in where they generated a $ Net Operating Loss.

Parents activity:

Parent had separate taxable income of $ which included an $ long term capital gain.

Parent made a $ charitable contribution during the year which is included in their separate taxable income.

Parent also received the following dividends included in their separate taxable income: $ dividend from a lessthanowned corporation, and a $ dividend from Sub.

Subs income:

Sub generated $ of separate taxable income and also incurred a $ short term capital loss.

Subs separate taxable income includes a gain of $ from the sale of equipment. Sub had purchased the equipment from Parent in and Parent realized a gain of $ from that sale.

Finally, Sub paid $ in charitable contributions which is included in their separate taxable income.

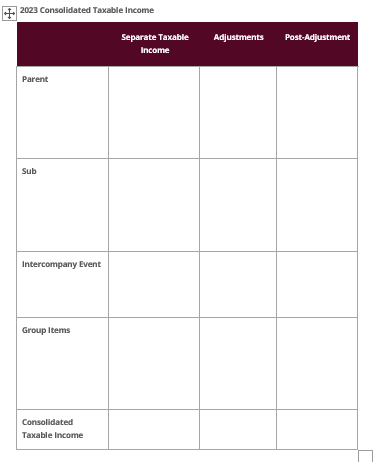

Using the facts above and the NOL carryforward available from calculate Consolidated Taxable Income for Note that none of the SRLY or limitations are applicable to the NOL carryforward

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock