Question: Parent Ltd has asked for your help in the preparation of consolidated financial statements for the financial year ended 31 March 2022; they value

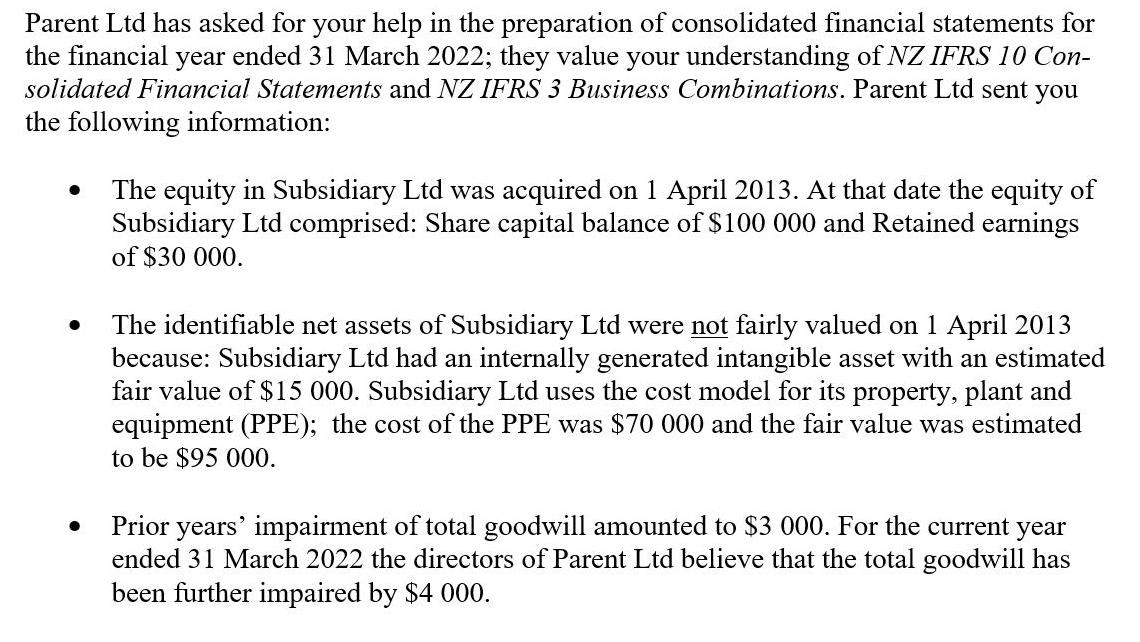

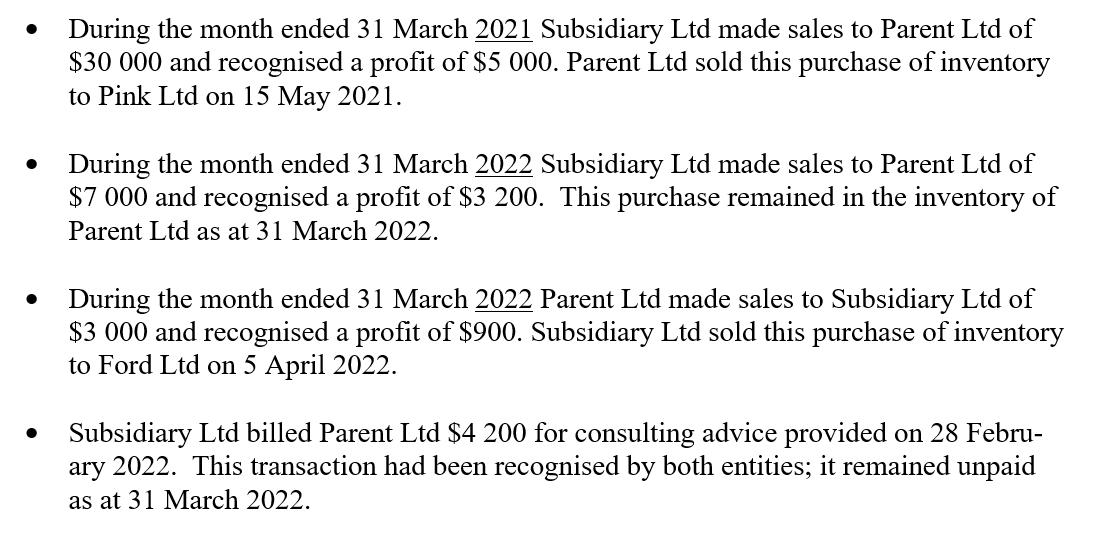

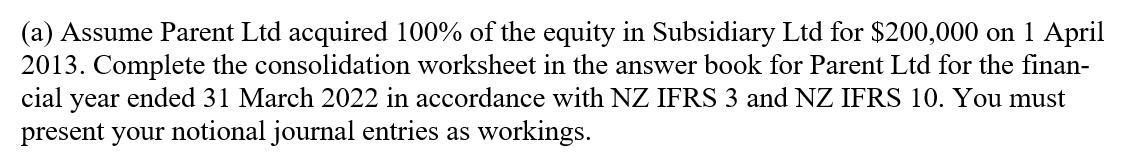

Parent Ltd has asked for your help in the preparation of consolidated financial statements for the financial year ended 31 March 2022; they value your understanding of NZ IFRS 10 Con- solidated Financial Statements and NZ IFRS 3 Business Combinations. Parent Ltd sent you the following information: The equity in Subsidiary Ltd was acquired on 1 April 2013. At that date the equity of Subsidiary Ltd comprised: Share capital balance of $100 000 and Retained earnings of $30 000. The identifiable net assets of Subsidiary Ltd were not fairly valued on 1 April 2013 because: Subsidiary Ltd had an internally generated intangible asset with an estimated fair value of $15 000. Subsidiary Ltd uses the cost model for its property, plant and equipment (PPE); the cost of the PPE was $70 000 and the fair value was estimated to be $95 000. Prior years' impairment of total goodwill amounted to $3 000. For the current year ended 31 March 2022 the directors of Parent Ltd believe that the total goodwill has been further impaired by $4 000. During the month ended 31 March 2021 Subsidiary Ltd made sales to Parent Ltd of $30 000 and recognised a profit of $5 000. Parent Ltd sold this purchase of inventory to Pink Ltd on 15 May 2021. During the month ended 31 March 2022 Subsidiary Ltd made sales to Parent Ltd of $7 000 and recognised a profit of $3 200. This purchase remained in the inventory of Parent Ltd as at 31 March 2022. During the month ended 31 March 2022 Parent Ltd made sales to Subsidiary Ltd of $3 000 and recognised a profit of $900. Subsidiary Ltd sold this purchase of inventory to Ford Ltd on 5 April 2022. Subsidiary Ltd billed Parent Ltd $4 200 for consulting advice provided on 28 Febru- ary 2022. This transaction had been recognised by both entities; it remained unpaid as at 31 March 2022. (a) Assume Parent Ltd acquired 100% of the equity in Subsidiary Ltd for $200,000 on 1 April 2013. Complete the consolidation worksheet in the answer book for Parent Ltd for the finan- cial year ended 31 March 2022 in accordance with NZ IFRS 3 and NZ IFRS 10. You must present your notional journal entries as workings. Income statement/dividend items: Income (all types of income) Less expenses (all types of expenses) Profit before tax Less income tax expense Profit after tax Retained earnings - opening balance Less: dividends declared Balance Sheet items: Retained earnings - closing balance Share capital Total equity Various liabilities Consulting fee payable to Sub Ltd Bank loan Total liabilities Total equity and liabilities Receivables Inventory PPE Investment in Subsidiary Ltd Total assets Parent Ltd $ 522 500 410 000 112 500 50 000 62 500 50 000 50 000 62 500 400 000 462 500 125 800 4 200 92 500 222 500 $685 000 40 000 120 000 325 000 200 000 Sub Ltd $ 275 000 197 000 78 000 18 000 60 000 40 000 15 000 85 000 100 000 185 000 70 000 30 000 100 000 285 000 20 000 55 000 210 000 $685 000 $285 000 Notional Journal Entries Dr $ Cr $ $ Group S

Step by Step Solution

3.54 Rating (147 Votes )

There are 3 Steps involved in it

To prepare the consolidated financial statements for Parent Ltd for the financial year ended 31 March 2022 we need to account for the acquisition of Subsidiary Ltd and eliminate any intercompany trans... View full answer

Get step-by-step solutions from verified subject matter experts