Question: Part 1 1. ABC Corp is contemplating a project with a cost of $35,000. It has an expected net cash inflow of $9,000 per year

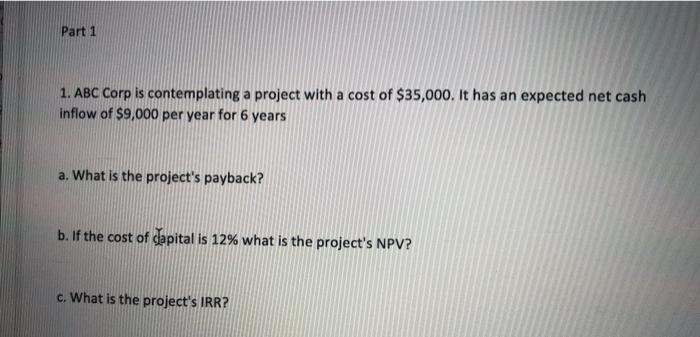

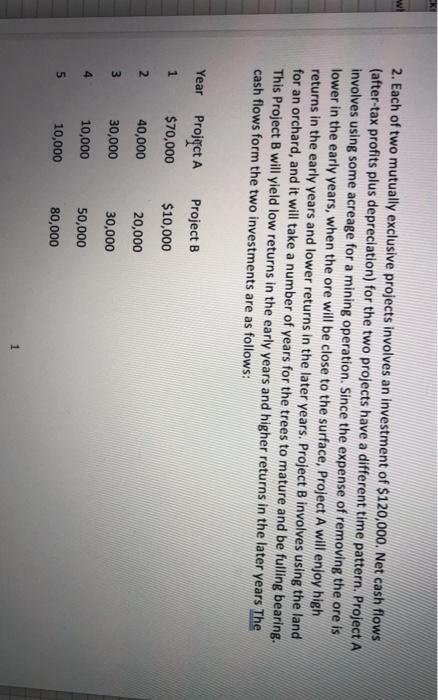

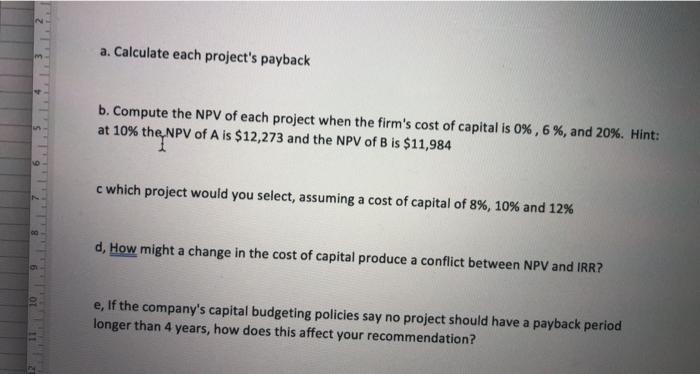

Part 1 1. ABC Corp is contemplating a project with a cost of $35,000. It has an expected net cash inflow of $9,000 per year for 6 years a. What is the project's payback? b. If the cost of capital is 12% what is the project's NPV? c. What is the project's IRR? w 2. Each of two mutually exclusive projects involves an investment of $120,000. Net cash flows (after-tax profits plus depreciation) for the two projects have a different time pattern. Project A involves using some acreage for a mining operation. Since the expense of removing the ore is lower in the early years, when the ore will be close to the surface, Project A will enjoy high returns in the early years and lower returns in the later years. Project B involves using the land for an orchard, and it will take a number of years for the trees to mature and be fulling bearing. This Project B will yield low returns in the early years and higher returns in the later years The cash flows form the two investments are as follows: Year Project A $70,000 Project B $10,000 1 2 40,000 20,000 3 30,000 30,000 4 10,000 50,000 5 10,000 80,000 1 a. Calculate each project's payback b. Compute the NPV of each project when the firm's cost of capital is 0%, 6%, and 20%. Hint: at 10% the, NPV of A is $12,273 and the NPV of B is $11,984 c which project would you select, assuming a cost of capital of 8%, 10% and 12% d, How might a change in the cost of capital produce a conflict between NPV and IRR? e, If the company's capital budgeting policies say no project should have a payback period longer than 4 years, how does this affect your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts