Question: part 1 - 12 question. please explain in detail & please dont use excel. Benefits of diversification Sally Rogers has decided to invest her wealth

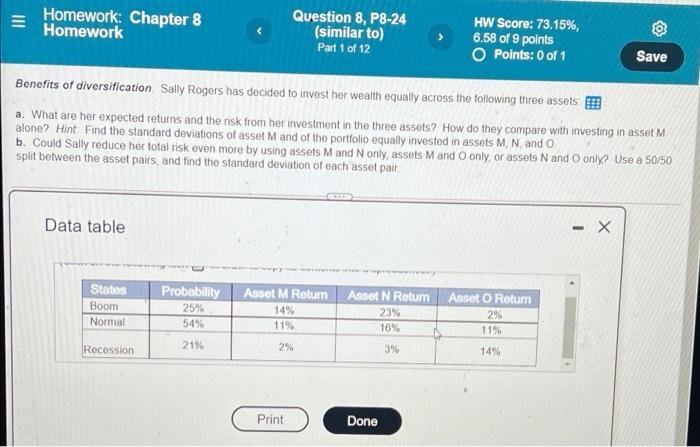

Benefits of diversification Sally Rogers has decided to invest her wealth equally across the following three assets ? a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset M alone? Hint Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and o b. Could Sally reduce her total risk even more by using assets M and N only assets M and only, or assets N and only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair a. What is the expected return of investing equally in all three assets M, N, and ? 0% (Round to two decimal places) III Homework: Chapter 8 Homework Question 8, P8-24 (similar to) Part 1 of 12 HW Score: 73.15%, 6.58 of 9 points Points: 0 of 1 Save Benefits of diversification Sally Rogers has decided to invest her wealth equally across the following three assets ? a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset M alone? Hint Find the standard deviations of asset M and of the portfolio equally invested in assets M, N and O. b. Could Sally reduce her total risk even more by using assets and N only, assets M and only, or assets N and only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair Data table - States Boom Normal Probability 25% 54% Asset M Return 14% 11% Asset N Rotum 23% 16% Asset O Rotum 2% 11% Recession 21% 2% 3% 14% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts