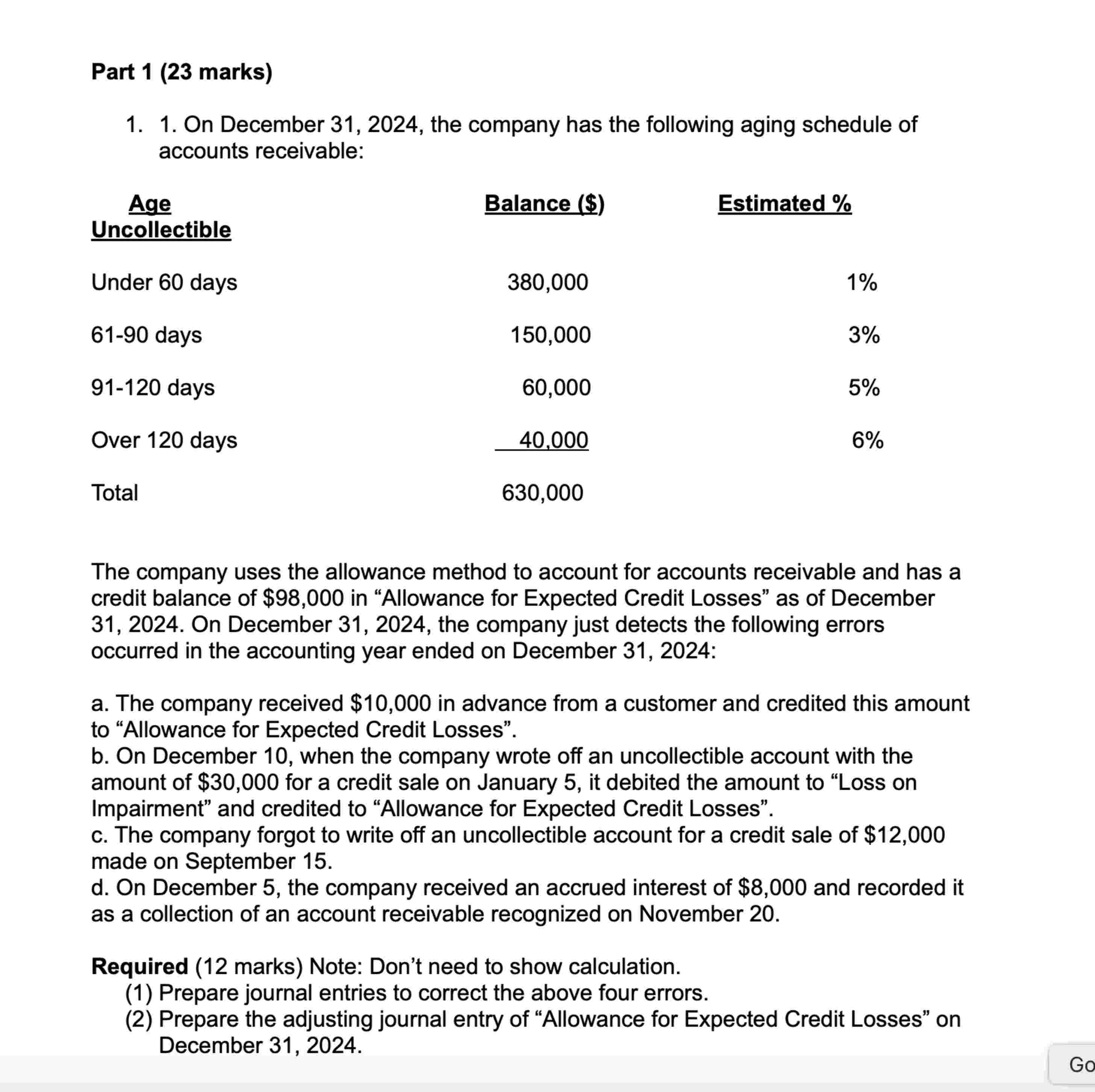

Question: Part 1 ( 2 3 marks ) 1 . 1 . On December 3 1 , 2 0 2 4 , the company has the

Part marks On December the company has the following aging schedule of accounts receivable: The company uses the allowance method to account for accounts receivable and has a credit balance of $ in "Allowance for Expected Credit Losses" as of December On December the company just detects the following errors occurred in the accounting year ended on December : a The company received $ in advance from a customer and credited this amount to "Allowance for Expected Credit Losses". b On December when the company wrote off an uncollectible account with the amount of $ for a credit sale on January it debited the amount to "Loss on Impairment" and credited to "Allowance for Expected Credit Losses". c The company forgot to write off an uncollectible account for a credit sale of $ made on September d On December the company received an accrued interest of $ and recorded it as a collection of an account receivable recognized on November Required marks Note: Don't need to show calculation. Prepare journal entries to correct the above four errors. Prepare the adjusting journal entry of "Allowance for Expected Credit Losses" on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock