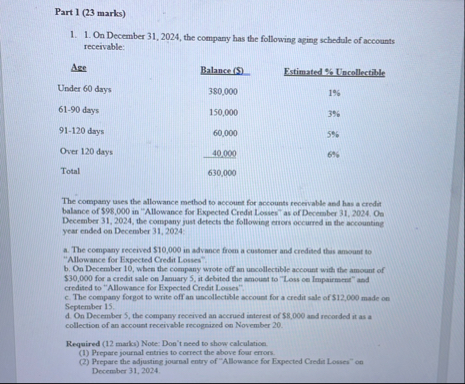

Question: Part 1 ( 2 3 marks ) On December 3 1 , 2 0 2 4 , the company has the following aging schedule of

Part marks

On December the company has the following aging schedule of accounts receivable:

Age

Under days

days

days

Over days

Total

Balance $

Fstimated Uncollectible

The company uses the allowance metbod to account for accounts recervable and has a credir balance of $ in "Allowance for Expected Credit Losses" as of December On December the company fust detects the following errors occurred in the accounting year ended on December

a The company receved $ is advance froen a customer and credited thas amsount to "Allowance for Expected Credit Losses",

b On December when the company wrote off an uncollectible account with the amoumt of $ for a credit sale on Jamary it delited the amount to "Loss ce Impairmeri" and crodited to "Allowance for Expected Credit Losses"

c The company forgot to write off an uncolloctible account for a credit sale of $ made on September

On December the company received an accrued interest of $ and reconded it as m collection of an account receivable recogrized on November

Required marks Note Don't seed to show calculation.

Prepare journal entries to correct the above four errors.

Prepare the adjusting journal entry of "Allowance for Expected Creder Losses" on December

Please help me

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock