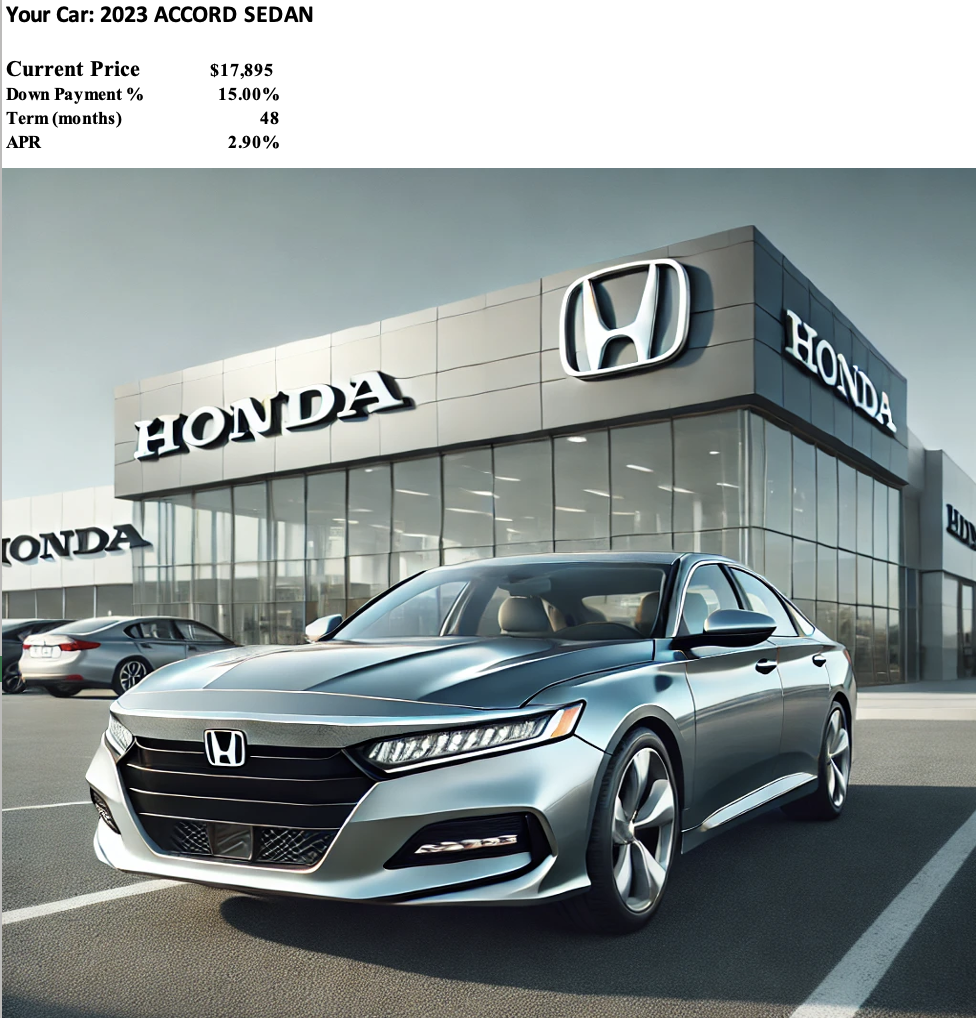

Question: Part 1 ( 3 5 Points ) Purchasing your preowned car You have contacted your dealership and they have provided information regarding the price and

Part Points

Purchasing your preowned car

You have contacted your dealership and they have provided information regarding the price and financing alternatives for the car that you would like to purchase. Information is included in the provided worksheet

You want to check the information that they have provided and want to calculate some sensitivity around the purchase of the car.

On an excel worksheet calculate the following:

SCENARIO Base Case and Amortization Schedule. points

Calculate the effective monthly rate that will be used to pay your loan.

Calculate your monthly car payment

Construct a loan amortization table Considering monthly payments

How much will you have to pay in interest payments throughout the life of the loan total interest paid

What is the effective Rate?

What is the principal amount left to pay halfway though the life of the loan years

SCENARIO points

Based on your Base Scenario or Scenario what happens to your effective monthly rate, monthly payment, and total interest throughout the life of the loan if your rate APR decreases by

SCENARIO points

Based on Scenario what happens if you pay an additional $ per month?

How much is your new payment?

How many months will you finish paying your loan?

How much do you save on interest?

CONCLUSION points

What did you learn from this exercise?

What has more impact in the purchase of the vehicle? A decrease in APR or an increase in payment?

Use the scenario analysis to help you conclude? what effect does paying more have on the life of the loan, what is the effect on the change of interest rate.... How is it best to manage your loan?

PART Bonds and Investment Options points

Jenna believes she could easily set aside $ of her $ salary. She is considering putting her savings in a stock fund. She just turned and has a long way to go until retirement at age and she considers this risk level reasonable. The fund she is looking at has earned an average of over the past years and could be expected to continue earning this amount, on average. While she has no current retirement savings, five years ago Jennas grandparents gave her a new year US Treasury bond with a $ face value.

Jenna wants to know her retirement income if she both sells her Treasury bond at its current market value and investsthe proceeds in the stock fund and saves an additional $ at the end of each year in the stock fund from now until she turns Once she retires, Jenna wants those savings to last for years until she is

Suppose Jennas Treasury bond has a coupon interest rate of paid semiannually, while currentTreasury bonds with the same maturity date have a yield to maturity of expressed as an APRwith semiannual compounding If she has just received the bonds th coupon, for how much can Jenna sell her treasury bond?

Suppose Jenna sells the bond, reinvests the proceeds, and then saves as she planned. If indeed, Jenna earns an annual return on her savings, how much could she withdraw each year in retirement? Assumeshe begins withdrawing the money from the account in equal amounts at the end of each year once her retirement begins.

Should Jenna sell her treasury bond and invest the proceeds in the stock fund? Give one reason for and against the plan?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock