Question: PART 1 ( 3 8 pts ) : To answer the below questions, please use the attached financial statements of Apple company, presented in Appendix

PART pts: To answer the below questions, please use the attached financial statements of Apple company, presented in Appendix

Question pts: Using the year as the base year, compute trend percentages for fiscal years and for total net sales, total cost of sales, operating income, and net income.

tableTotal Net Sales,,,The Cost of Sales,,,Operating Income,,,Net Income,,,

PART pts: To answer the below questions, please use the attached financial statements of Apple company, presented in Appendix

Question pts: Using the year as the base year, compute trend percentages for fiscal years and for total net sales, total cost of sales, operating income, and net income.

tableTotal Net Sales,,,The Cost of Sales,,,Operating Income,,,Net Income,,,

PART pts: To answer the below questions, please use the attached financial statements of Apple company, presented in Appendix

Question pts: Using the year as the base year, compute trend percentages for fiscal years and for total net sales, total cost of sales, operating income, and net income.

tableTotal Net Sales,,,The Cost of Sales,,,Operating Income,,,Net Income,,,

Question pts: By referring your answers to question ;

a Comment on if there is a clear increasingdecreasing trend for the specified items.

b If there are any trends, please specify whether the trends are compatible with each other

or not if trend percentages go handinhand for all items or diverge from each other

c If the trend percents diverge from each other, what could be the possible reason for it

Answer: Question pts:

a Calculate the profit margin ratio and return on assets for the years and

and fill in the below table.

b Did profit margin improve or worsen for Apple? Explain all your rationale, please Only

the answer of improveworsen will not be accepted

c Based on return on assets, please comment on whether Apple's operating efficiency

improved or worsened in versus Explain all your rationale please. Only

the answer of improveworsen will not be accepted

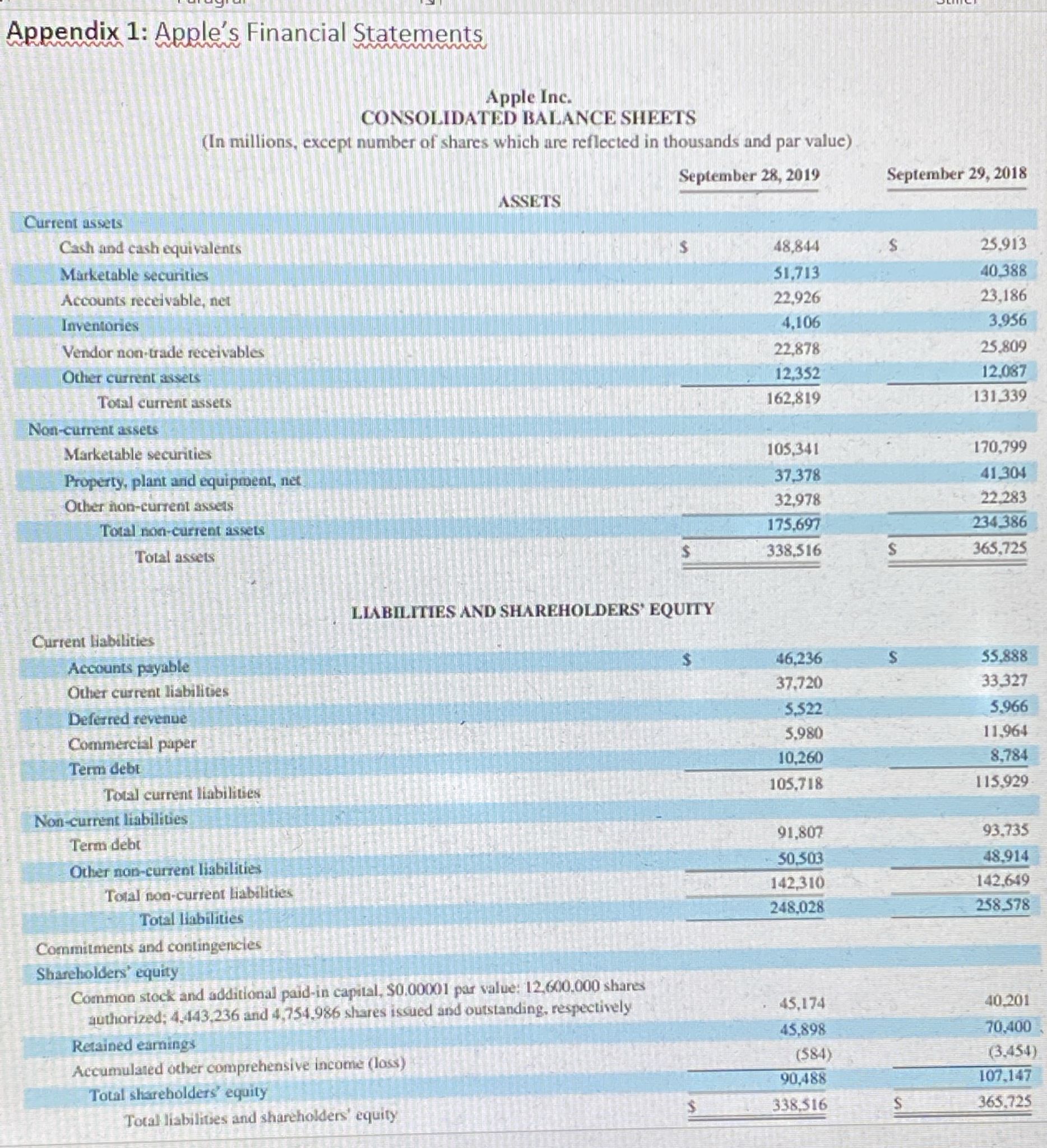

Answer:Question pts: Using current assets as a percent of total assets to measure liguidity, did

Apple's assets become more liguid of less liquid in Explain all your rationale please.

Only the answer of yesno will not be accepted

Answer:

Question pts: Here are the additional key figures for Apple and Google.

a If Google paid a dividend, would the value of retained earnings as a percent of total assets

increase or decrease? Explain your rationale please Only the answer of

increasedecrease will not be accepted

b Which company has the better gross profit margin ratio on sales? Show all your

calculations, please Only the answer of AppleGoogle will not be accepted

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock