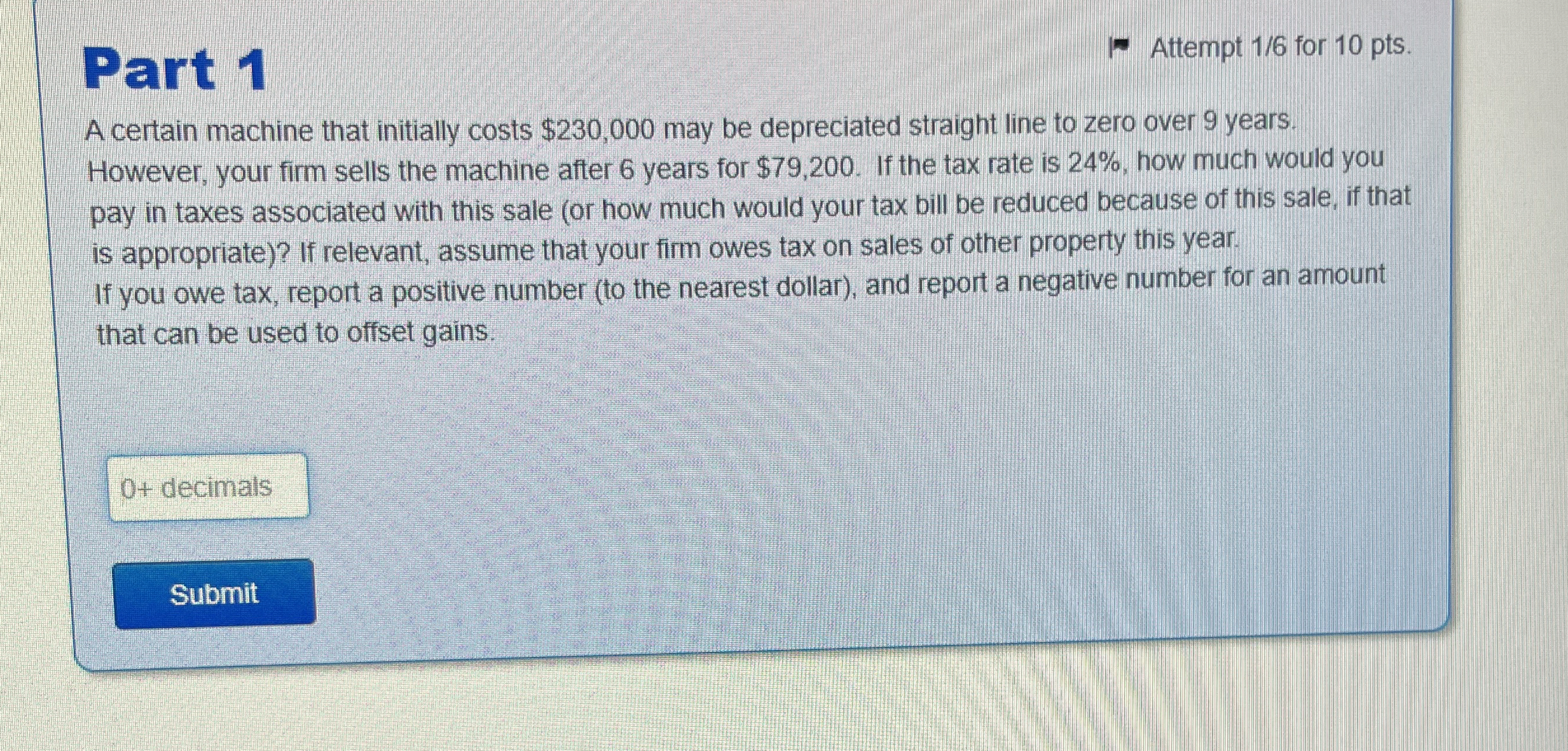

Question: Part 1 A certain machine that initially costs $ 2 3 0 , 0 0 0 may be depreciated straight line to zero over 9

Part

A certain machine that initially costs $ may be depreciated straight line to zero over years.

However, your firm sells the machine after years for $ If the tax rate is how much would you

pay in taxes associated with this sale or how much would your tax bill be reduced because of this sale, if that

is appropriate If relevant, assume that your firm owes tax on sales of other property this year.

If you owe tax, report a positive number to the nearest dollar and report a negative number for an amount

that can be used to offset gains.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock