Question: Part 1 (a) Explain why an American call options on futures could be optimally exercised early while call options on the spot can not be

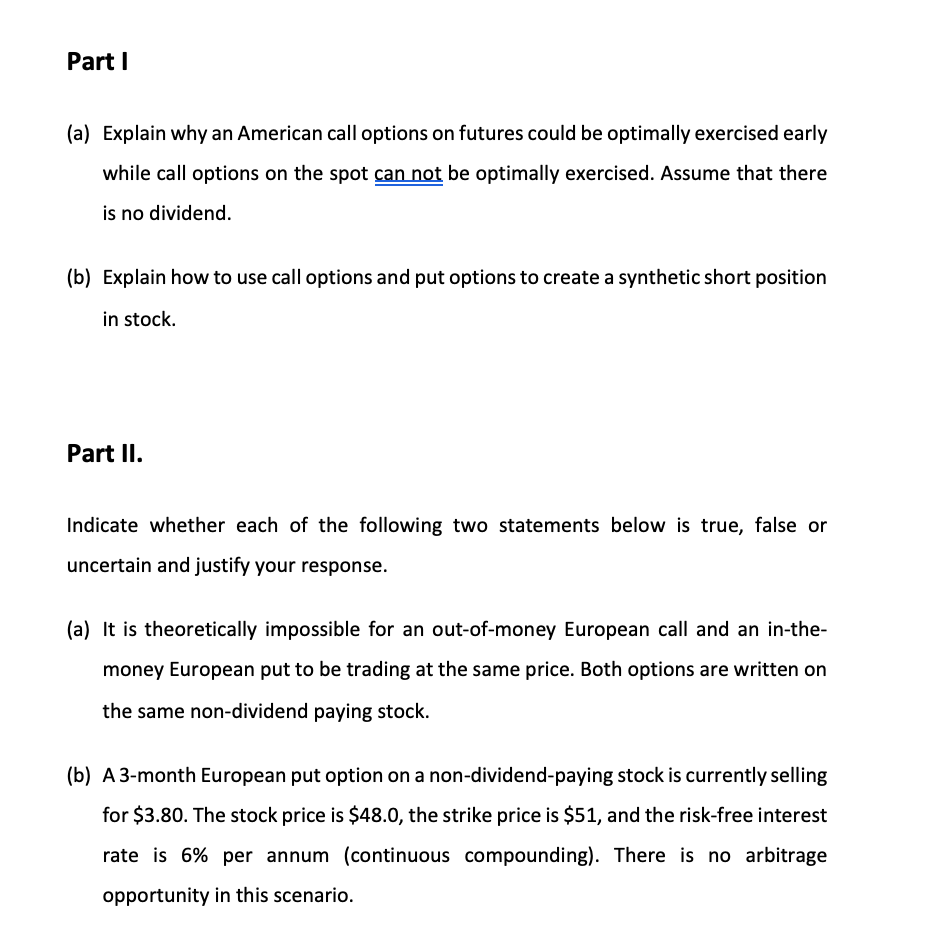

Part 1 (a) Explain why an American call options on futures could be optimally exercised early while call options on the spot can not be optimally exercised. Assume that there is no dividend. (b) Explain how to use call options and put options to create a synthetic short position in stock. Part II. Indicate whether each of the following two statements below is true, false or uncertain and justify your response. (a) It is theoretically impossible for an out-of-money European call and an in-the- money European put to be trading at the same price. Both options are written on the same non-dividend paying stock. (b) A 3-month European put option on a non-dividend-paying stock is currently selling for $3.80. The stock price is $48.0, the strike price is $51, and the risk-free interest rate is 6% per annum (continuous compounding). There is no arbitrage opportunity in this scenario. Part 1 (a) Explain why an American call options on futures could be optimally exercised early while call options on the spot can not be optimally exercised. Assume that there is no dividend. (b) Explain how to use call options and put options to create a synthetic short position in stock. Part II. Indicate whether each of the following two statements below is true, false or uncertain and justify your response. (a) It is theoretically impossible for an out-of-money European call and an in-the- money European put to be trading at the same price. Both options are written on the same non-dividend paying stock. (b) A 3-month European put option on a non-dividend-paying stock is currently selling for $3.80. The stock price is $48.0, the strike price is $51, and the risk-free interest rate is 6% per annum (continuous compounding). There is no arbitrage opportunity in this scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts