Question: Part 1 : Adjusting Journal Entries Your first task is to prepare the required adjusting journal entries for the year ended December 3 1 ,

Part : Adjusting Journal Entries

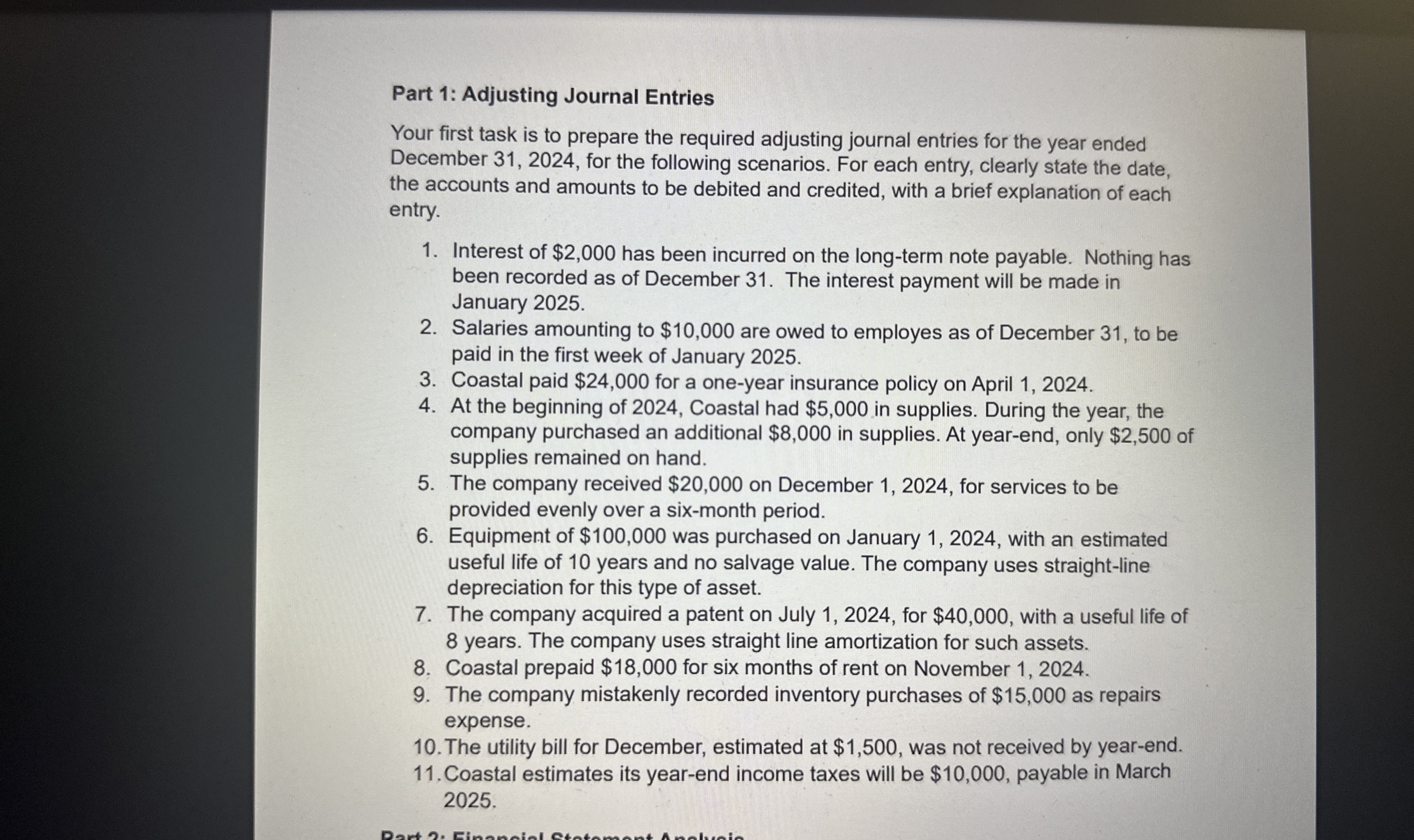

Your first task is to prepare the required adjusting journal entries for the year ended

December for the following scenarios. For each entry, clearly state the date,

the accounts and amounts to be debited and credited, with a brief explanation of each

entry.

Interest of $ has been incurred on the longterm note payable. Nothing has

been recorded as of December The interest payment will be made in

January

Salaries amounting to $ are owed to employes as of December to be

paid in the first week of January

Coastal paid $ for a oneyear insurance policy on April

At the beginning of Coastal had $ in supplies. During the year, the

company purchased an additional $ in supplies. At yearend, only $ of

supplies remained on hand.

The company received $ on December for services to be

provided evenly over a sixmonth period.

Equipment of $ was purchased on January with an estimated

useful life of years and no salvage value. The company uses straightline

depreciation for this type of asset.

The company acquired a patent on July for $ with a useful life of

years. The company uses straight line amortization for such assets.

Coastal prepaid $ for six months of rent on November

The company mistakenly recorded inventory purchases of $ as repairs

expense.

The utility bill for December, estimated at $ was not received by yearend.

Coastal estimates its yearend income taxes will be $ payable in March

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock