Question: part 1 and 2 please please be organized I apologize. it's part 1a and part 1b Required information Exercise 10-11 (Static) IFRS; acquisition cost; issuance

![cost; issuance of equity securities and donation [LO10-4, 10-9] [The following information](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e89204738b1_76366e89203df87f.jpg)

part 1 and 2 please please be organized

I apologize. it's part 1a and part 1b

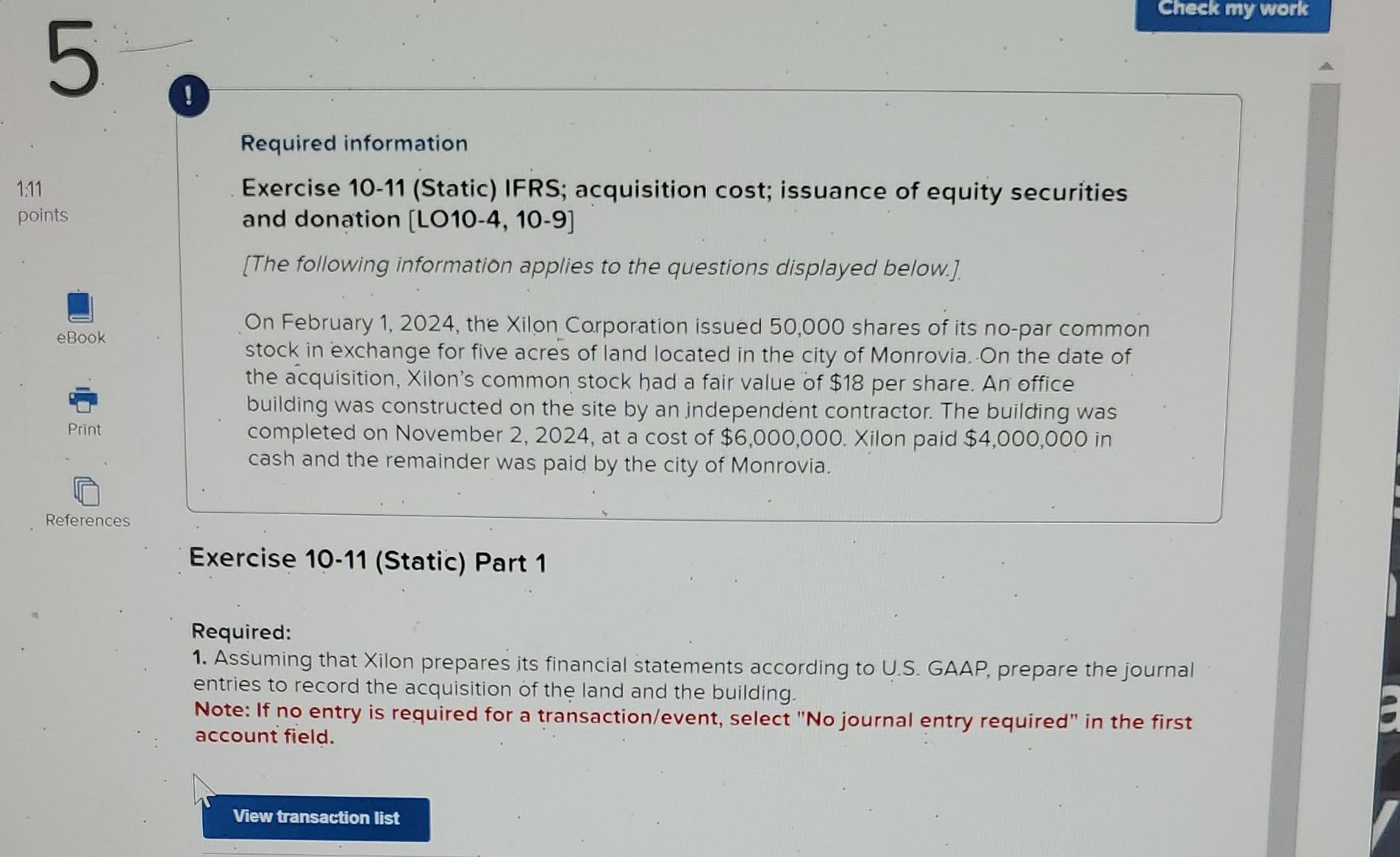

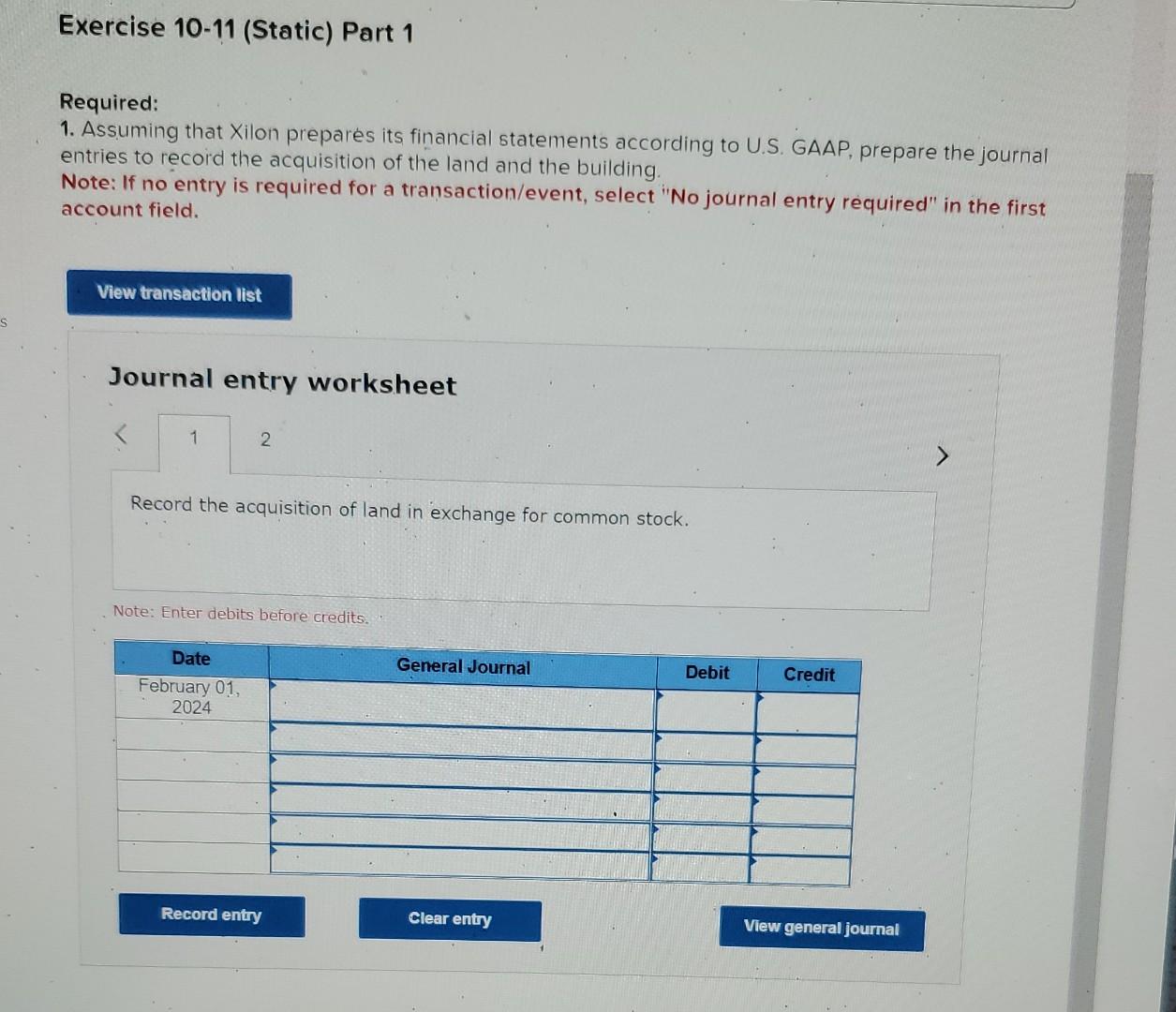

Required information Exercise 10-11 (Static) IFRS; acquisition cost; issuance of equity securities and donation [LO10-4, 10-9] [The following information applies to the questions displayed below.]. On February 1, 2024, the Xilon Corporation issued 50,000 shares of its no-par common stock in exchange for five acres of land located in the city of Monrovia. On the date of the acquisition, Xilon's common stock had a fair value of $18 per share. An office building was constructed on the site by an independent contractor. The building was completed on November 2,2024 , at a cost of $6,000,000. Xilon paid $4,000,000 in cash and the remainder was paid by the city of Monrovia. Exercise 1011 (Static) Part 1 Required: 1. Assuming that Xilon prepares its financial statements according to U.S. GAAP, prepare the journal entries to record the acquisition of the land and the building. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required: 1. Assuming that Xilon prepares its financial statements according to U.S. GAAP, prepare the journal entries to recoid the acquisition of the land and the building. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the acquisition of land in exchange for common stock. Note: Enter debits before credits. Required: 1. Assuming that Xilon prepares its financial statements according to U.S. GAAP, prepare the journal entries to record the acquisition of the land and the building. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the acquisition of a building through purchase and donation. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts