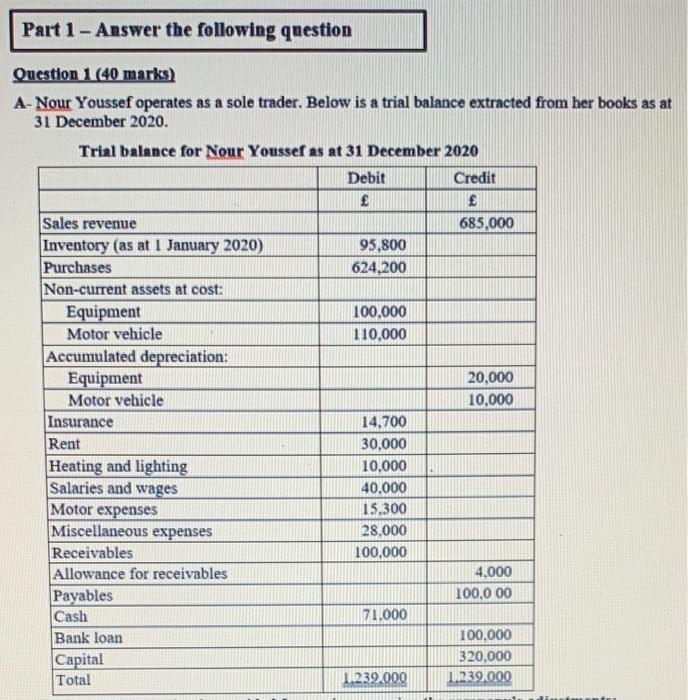

Question: Part 1 - Answer the following question Question 1 (40 marks) A-Nour Youssef operates as a sole trader. Below is a trial balance extracted from

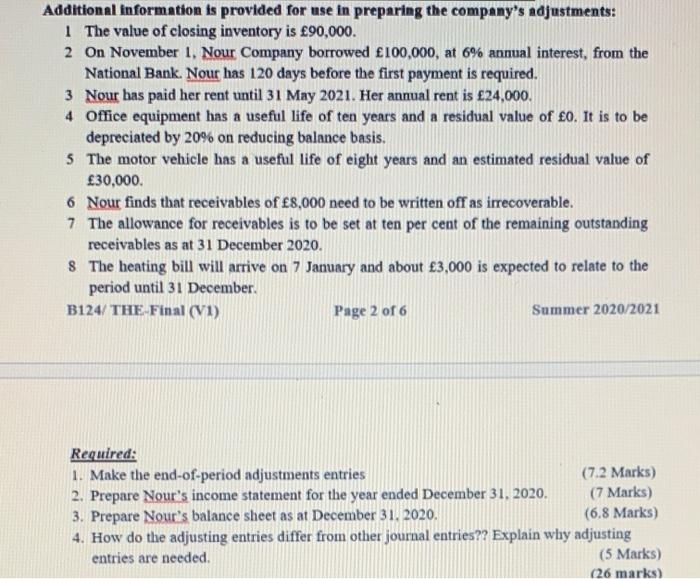

Part 1 - Answer the following question Question 1 (40 marks) A-Nour Youssef operates as a sole trader. Below is a trial balance extracted from her books as at 31 December 2020. Trial balance for Nour Youssef as at 31 December 2020 Debit Credit E E Sales revenue 685.000 Inventory (as at 1 January 2020) 95,800 Purchases 624.200 Non-current assets at cost: Equipment 100.000 Motor vehicle 110,000 Accumulated depreciation: Equipment 20.000 Motor vehicle 10.000 Insurance 14,700 Rent 30,000 Heating and lighting 10.000 Salaries and wages 40.000 Motor expenses 15.300 Miscellaneous expenses 28,000 Receivables 100,000 Allowance for receivables 4.000 Payables 100,0 00 Cash 71.000 Bank loan 100.000 Capital 320.000 Total 1.239.000 1.239 000Additional information is provided for use in preparing the company's adjustments: 1 The value of closing inventory is $90,000. 2 On November 1, Nour Company borrowed $100,000, at 6% annual interest, from the National Bank. Nour has 120 days before the first payment is required. 3 Nour has paid her rent until 31 May 2021. Her annual rent is $24,000, 4 Office equipment has a useful life of ten years and a residual value of CO. It is to be depreciated by 20% on reducing balance basis. 5 The motor vehicle has a useful life of eight years and an estimated residual value of $30,000. 6 Nour finds that receivables of E8,000 need to be written off as irrecoverable. 7 The allowance for receivables is to be set at ten per cent of the remaining outstanding receivables as at 31 December 2020. 8 The heating bill will arrive on 7 January and about $3,000 is expected to relate to the period until 31 December. B124/ THE-Final (V1) Page 2 of 6 Summer 2020/2021 Required: 1. Make the end-of-period adjustments entries (7.2 Marks) 2. Prepare Nour's income statement for the year ended December 31, 2020. (7 Marks) 3. Prepare Nour's balance sheet as at December 31. 2020. (6.8 Marks) 4. How do the adjusting entries differ from other journal entries?? Explain why adjusting entries are needed. (5 Marks) (26 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts