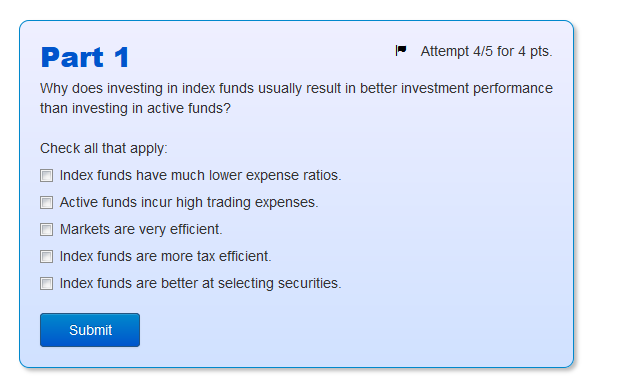

Question: Part 1 | Attempt 4/5 for 4 pts. Why does investing in index funds usually result in better investment performance than investing in active funds?

Part 1 | Attempt 4/5 for 4 pts. Why does investing in index funds usually result in better investment performance than investing in active funds? Check all that apply: Index funds have much lower expense ratios. Active funds incur high trading expenses. Markets are very efficient. Index funds are more tax efficient. Index funds are better at selecting securities. Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts